Over the past few years, efforts to drive financial inclusion in India have delivered mixed results. Access to bank accounts has increased dramatically, driven by a strong policy and regulatory push. But the usage of these accounts and the uptake of formal financial services beyond savings accounts, has remained exceptionally difficult.

Why might this be happening, and could ‘technology’ be a game changer? How might policymakers nudge this process in the right direction?

The unique Indian household

Let’s start by understanding the problem. A recent study suggests that Indian households display three unique financial behaviours.

- First, they allocate a disproportionately high share of their wealth to physical assets–amounting to a staggering 95% of the household balance sheet (compared to about 35% in advanced economies).

- Second, households borrow heavily from non-institutional sources. Approximately 56% of debt is unsecured (compared to less than 15% in advanced countries).

- Third, there is a near-total absence of investment in pension products, and low insurance penetration (both life and non-life)– accounting together for less than 5% of the household balance sheet (vis-à-vis 15-25% in the advanced economies).

The gap between what is available and what is needed

Part of the issue has been limited supply- side innovation: Dalberg’s work on understanding the financial health of low-income segments in India shows that the reliance on financial products from non-institutional sources is high because these tend to be more tailored to their economic lives, e.g., account for their erratic cash flows and evolving financial priorities, and because they are perceived to be more helpful in times of need (as opposed to the one-size-fits-all solutions offered by traditional banks).

Further, households also lack an avenue to receive credible, low-cost and high-quality financial advice. Decisions are based either on hearsay, or on local advisers who may have misaligned incentives.

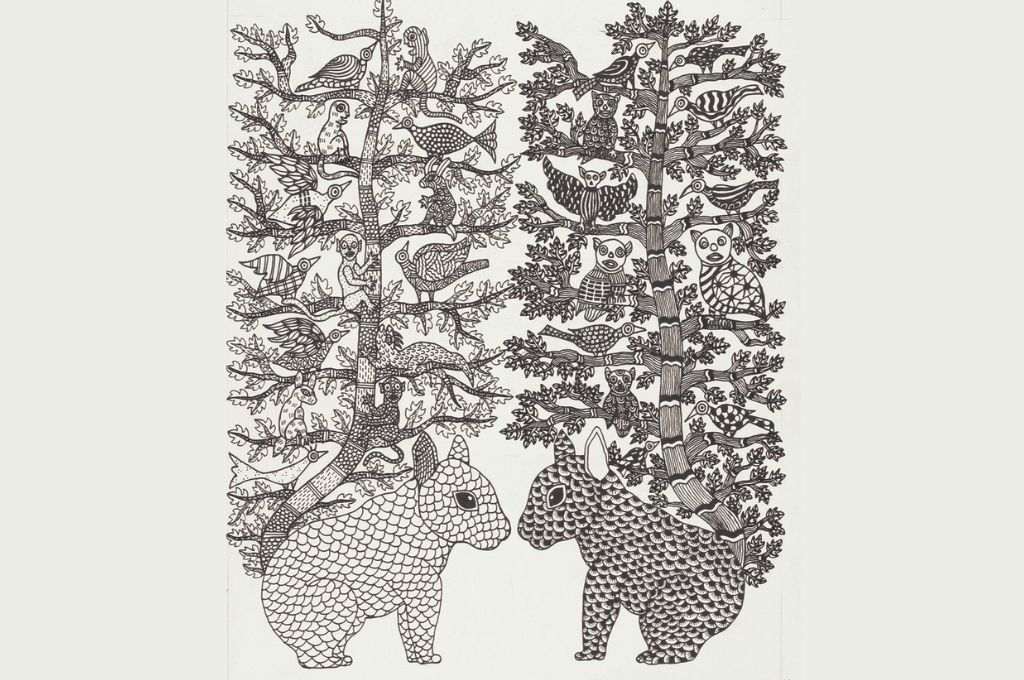

Photo Courtesy: Omidyar Network

Enter fintech

In this complex context, we think technology can help in three ways.

- First, technology can provide more tailored financial products to the mass-market consumer. For example, alternative data-based lenders (who lend based on data trails such as payments history) are beginning to serve the large unmet credit need of those who would usually rely on a non-institutional source, by offering suitable credit products (low-ticket size, no collateral requirements, instant disbursal, etc.).

- Second, technology can offer a simpler and seamless user experience—think of the difference in receiving money using BHIM or a mobile wallet versus your earlier experience of receiving and depositing cheques.

- Third, public good tech infrastructure is dramatically reducing cost to serve. Electronic know your customer, for example, that builds on the Aadhaar platform has already reduced time to on-board a customer from a few days to a few minutes.

Fintech thus holds great promise to drive financial inclusion 2.0 in India. But at present, fintech offerings remain primarily accessible to “elite India”. If fintech has the potential to be a game changer for inclusion, why are we not seeing more innovation for the mass market and the so-called “base of pyramid” (BoP) consumer?

Fintech for fin-clusion

While there are several demand and supply side factors explaining this, our extensive recent consultations with over 50 Indian fintech institutions suggest that some regulatory barriers still persist.

Consider a firm that wants to launch a micro-insurance product, purchasable using mobile airtime. The firm will collaborate with telecom players for distribution, and with insurance providers for underwriting risk. However, the firm will require regulatory clarity, since its product will attract the purview of multiple regulators (the Insurance Regulatory and Development Authority, the Telecom Regulatory Authority of India, and possibly the Reserve Bank of India) but regulators are unable to accurately assess the risks associated with such a new product, and regulatory coordination is limited. As a result, the firm will have to abort the launch due to regulatory ambiguity.

Can we create an avenue that avoids such situations by helping regulators understand the risks and benefits associated with a new product, in a rigorous and streamlined way?

Photo Courtesy: Omidyar Network

Enter Sandbox

An innovation that could help is that of a “regulatory sandbox”- an entity, hosted or endorsed by the regulators, that enables temporary, limited-scale testing of a new product, to assess the potential benefits and risks posed by such a move to consumers or the market.

In the micro-insurance case, the regulators could ask the firm to test their product in a sandbox setting for a limited period (say, three months) and on a restricted scale (say, 10,000 consumers), while laying out metrics for evaluation. This would generate the evidence required to help regulators decide on benefits vis-à-vis risks and how best to regulate it.

After consulting with fintech institutions and regulators in five different countries, many of whom have set up their own sandboxes, we believe that the Indian sandbox should have five key features.

- First, since consumers do not view financial products in regulatory silos, the sandbox should be designed as single and integrated, serving all four financial sector regulators.

- Second, it should strike the balance of being autonomous, yet be embedded in the regulators. This will help in hiring market professionals for technical roles and foster a culture of innovation, while remaining within the regulatory purview.

- Third, the role of the sandbox should only be to assist the regulator by providing evidence for decision making, not replace it. It should not have any direct powers to relax, amend or draft new regulations.

- Fourth, the sandbox should have robust systems to identify, quantify and monitor risks emerging from the new product during testing.

- Finally, the engagement process for industry should be business-friendly. For this, the sandbox should offer a single point of contact, have a charter promising time-bound action, and rely on objective metrics-driven assessment.

We believe a sandbox approach can be a powerful tool in the Indian regulator’s arsenal. A regulatory sandbox, rooted in India’s realities, and custom-made for India, can become the flag-bearer of the nation’s next-generation financial inclusion imperatives.

—

This piece was co-authored by: Nadeem Khan, Nehal Garg, Varad Pande and Vineet Bhandari

The above is an edited excerpt from a two part series originally posted on Mint. You can find the original articles here: Part I and Part II.