Mental health is slowly becoming a part of the mainstream narrative, largely due to the pandemic. More and more people are talking about mental health concerns at work and in their homes. But when it comes to mental health, one segment that is usually overlooked is informal workers, especially women, who constitute a major part of this group. They are often in economically, socially, and mentally precarious conditions due to the absence of state regulations and protection in their line of work. The isolated nature of domestic work, harassment of street vendors by police officers, and construction sites dominated by men are just a few examples of the situations women in informal economy jobs find themselves in. These factors have been known to elevate stress levels, which have only heightened during the pandemic.

Essentially, stress is a psychological condition that arises when the demands of the external environment exceed an individual’s ability to cope. This definition holds true for how the pandemic affected people. Job loss, for instance, meant relying on savings accumulated across one’s lifetime; travel restrictions meant people couldn’t reach their places of work; and overall trends suggested less social and employment protection. Increased reliance on coping mechanisms that entail asset and saving depletion, clubbed with health and safety concerns, also put economic as well as emotional strain on women. While these concerns were applicable to both formal and informal sector workers, the absence of legal and social protection in addition to low, uncertain wages made women in the informal economy more vulnerable to abuse and exploitation.

In 2021, during the second wave of the pandemic in India, SEWA Bharat conducted relief efforts across the states of Delhi, Bihar, Jharkhand, and Uttarakhand. As part of this, 319 women were surveyed to gauge their preparedness for the second lockdown, their coping strategies, and the amount of stress they were experiencing. Data was collected using a psychological assessment tool called the perceived stress scale, which measures the degree to which people find situations in their life stressful. Contrary to other studies, these research findings revealed that the stress levels faced by women were not as high as expected. Forty-five percent of participants believed that things were going their way and 54 percent felt confident about their ability to deal with the challenges they were facing.

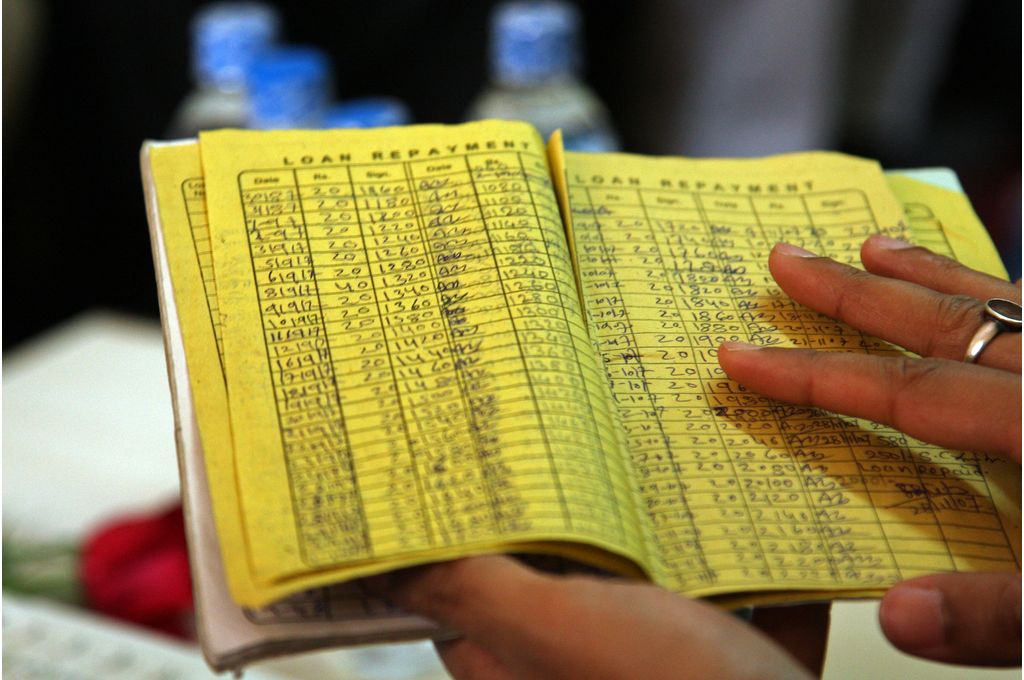

On digging further, it was discovered that the women surveyed were also members of the SEWA credit cooperatives in their respective states. This led to the conclusion that providing people with access to affordable financial products and services can help them cope with crises such as the COVID-19 pandemic. To ensure that informal sector workers are able to handle stressful situations in the future, it is imperative that states and civil society organisations increase individuals’ access to financial inclusion networks.

Financial inclusion can make women more resilient during emergencies

1. Credit cooperatives increase financial security

A credit cooperative is a nonprofit financial institution owned and controlled by its members. The board of directors comprises people from the community, making them acutely aware of the challenges fellow women face while interacting with other financial institutions. As a result, the policies and practices of the cooperatives are well informed by the experiences of their members and are particularly cognizant of the challenges they face with traditional banking institutions. It was observed that these cooperatives encouraged the opening of bank accounts, conducted financial and digital literacy courses that instilled the importance of saving, and provided access to low-interest loans and credit—all of which helped improve the financial security of their members. Research showed that many women only started saving money after being associated with credit cooperatives. This, combined with access to financial products such as loans at affordable interest rates via the credit cooperatives, created a buffer for women during the pandemic. This financial protection translated into mental health benefits, as it gave women the resources to be more resilient when faced with adversities.

The survey results also indicated that only about six percent of the participants had gone to a moneylender for loans during the course of the pandemic. Instead, women either took loans from the credit cooperatives or borrowed money from family members. Lack of adequate awareness about SHGs and credit cooperatives, along with the inaccessible nature of banking institutions, often make economically marginalised women turn to exploitative moneylenders. These lenders give money easily but at extremely high rates of interest that accumulate large, difficult-to-pay debts over time. Accumulation of debt is one of the primary causes of mental distress for workers in the informal economy. Reducing the same can improve their well-being as well as lead to better cognitive functioning and improved decision-making in everyday life. When women were given a choice, they were able to circumvent moneylenders, which increased their financial and mental well-being in the long run.

Accessibility to credit and loans also helped women sustain their existing income streams or the small businesses they were running. Multiple women, for instance, reported that they had taken loans from the credit cooperatives so that they could buy additional equipment to grow their business. Women also used this money to start alternative livelihoods. For instance, many reported buying sewing machines to produce masks during the pandemic.

2. Credit cooperatives create solidarity networks among women

Beyond acting as a financial safety net, cooperative membership gives rise to a sense of community that can further buffer the impact of stressful situations. Solidarity networks are built on values of care and commitment, which promotes mutual well-being of all members of the community. They create a space for people to share their experiences and highlight the universality of that experience. And so they can be seen as spaces that foster mental well-being and reduce stress. Members of SEWA credit cooperatives, for instance, interact with a bank saathi who comes to collect monthly deposits and helps in verification when loans have to be accessed. Bank sathis also become a mobilising point for the community, helping them collectivise to increase their bargaining power. This sense of belonging—having a feeling of something to fall back on—can enhance well-being by increasing confidence in the group’s problem-solving ability.

Policy and practice can inform measures that shape outcomes by making individuals more resilient and prepared.

The benefits that accrue from financial inclusion are multifold, and the pathways and mechanisms via which they impact the lives of women are also varied and diverse. While adversities and stressful events are uncertain, policy and practice can inform measures that shape outcomes by making individuals more resilient and prepared. Some policy interventions include:

Building community-centric interventions for care, inclusion, and support: This can enable women in the workforce to be better equipped to deal with systemic challenges that come their way. Community care is intrinsically connected to self-care and civil society organisations and government programmes must actively create place-based communities that help women build relationships they can depend on in times of crisis. The sense of solidarity and belongingness created by these groups is an important source of strength and resilience in individuals.

Providing women in grassroots communities with adequate access to resources and capital: Access to finance is linked to empowerment—not just for the women who can access it but also for other women in the community. If women can start their own small businesses they can further create employment opportunities for other women in the community.

Looking beyond mainstream financial institutions: Financial inclusion systems such as credit cooperatives can be more helpful for vulnerable communities. While banks and other such institutions require extensive paperwork in order to access loans, credit cooperatives make the vetting process easier. This increases access to financial products for marginalised populations such as migrant workers. Active efforts must also be taken to bring alternative financial services to the last mile. Locally placed financial institutions who have reliable points of contact between the bank and women in the informal economy make these services more accessible and approachable.

Generating awareness: Training programmes to facilitate financial and digital literacy that encourage saving practices can also build awareness among workers about the available financial service options they can avail.

—

Know more

- Learn more about the role of finance within communities.

- Read more about how informal workers have navigated the health risks of the pandemic.

- Understand the relationship between money and mental health.