The Pradhan Mantri Suraksha Bima Yojana is a social security scheme aimed at providing insurance against accidental death and disability to individuals between the ages of 18 and 70. The annual premium of INR 20 is automatically deducted from enrollees’ back accounts.

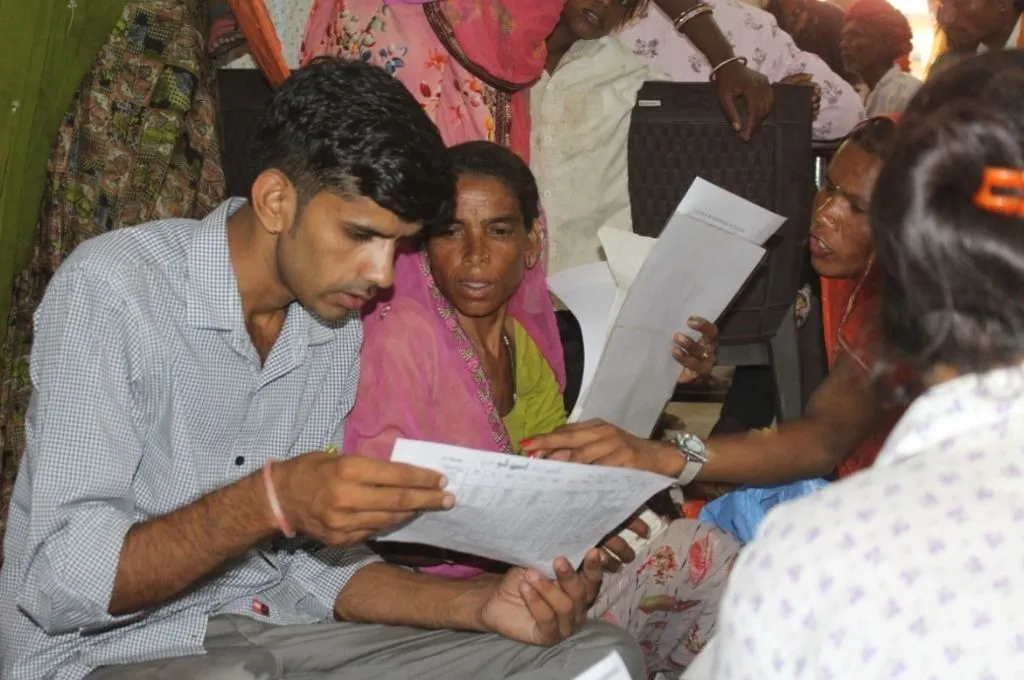

I work with Shram Sarathi, an organisation focused on the financial inclusion of migrant labour communities in Rajasthan’s Udaipur district. The communities that we serve are among the target groups of the scheme. However, we have observed that individuals typically find it very hard to file claims and receive what is due to them.

One reason for this is the cumbersome application process, which involves filling out forms and e-mailing information to the concerned insurance company. There are unexplained, excessive delays and claimants have to repeatedly follow up with banks and business correspondents—bank representatives who help people open bank accounts for a commission. This situation is especially problematic in rural areas, where financial literacy is already low.

Take the example of Phula Bai, a resident of Surajgarh village in Gogunda tehsil, who died on May 14, 2023, in a mining accident. An FIR and a post-mortem report were filed regarding the incident. Her nominee, Prabhu Lal, applied for the insurance claim at Union Bank of India, submitting all required documents, including the panchnama (on-site death report), FIR, post-mortem report, and other certificates.

Despite this, the bank kept asking for documents, and the processing of the claim was continuously delayed, for which the bank did not offer any explanations or reasons. Prabhu visited several bank branches, but each time he was told that the insurance amount had not yet been received. He even published his complaint in Dainik Bhaskar, but no assistance has been provided to date.

In another incident, Narayan Singh, a resident of Jaswantgarh village in Gogunda, died in a road accident on June 24, 2022. His wife was also severely injured in the accident and lost the ability to walk. Both had insurance through Union Bank of India, and their nominee, Dhapu Kunwar, applied for the insurance claim. Dhapu had to visit the bank multiple times, only to be told repeatedly that the insurance amount had not yet arrived. Once again, the bank didn’t give any further information.

One of the main issues we’ve noticed is the lack of clear communication between the insurance company and the bank. Everything happens over e-mail and only the bank is able to track the status of a claim, leaving the applicant in the dark. The process is informal and confusing for the applicants; they are simply told to submit papers at the branch, with no clear next steps.

When claimants fail to receive support from such social security schemes, their trust in these initiatives erodes. A simplified application process, timely processing of claims, and spreading awareness regarding digital tools can go a long way in addressing the issue.

Kishan Gurjar is a branch service manager at Shram Sarathi.

—

Know more: Learn how biometric processes are contributing to the rise of financial scams in Rajasthan.

Do more: Connect with the author at kishan.gurjar@shramsarathi.org to learn more about and support his work.