The COVID-19 pandemic devastated vulnerable communities, exacerbated existing inequalities, and pushed millions of people into vicious cycles of economic stagnation and livelihood loss. Building back will require a sustainable long-term strategy, as well as innovative funding to address the challenges faced by those most at risk.

Consider the following scenario: Padmaja is a 26-year-old woman who lives with her parents and runs a beauty parlour in Nagpur, Maharashtra. The COVID-19 pandemic affected her business and her income, making it extremely difficult for her to make ends meet for her family. Since she lives in a rented house and does not possess any other physical collateral, taking a bank loan is not a viable option for her. She would instead have to borrow from private moneylenders, which could entail repaying the loan at a high interest rate, possibly falling into a debt trap, and eventually being caught in a web of poverty.

However, Padmaja was afforded another option: she received a returnable grant, which allowed her to access credit, borrow money to support her family at the height of the pandemic, and restart her beauty parlour once restrictions were lifted. Due to the flexibility of the returnable grant, she was able to repay the money, which was then given to someone else in a similar situation.

What is a returnable grant?

A returnable grant (RG) is an innovative financial instrument that provides short-term, affordable, and flexible capital (zero interest and zero collateral) to individuals and entrepreneurs. The returnable grant levies individuals with a moral (and not legal) obligation to repay.

Here’s how it works

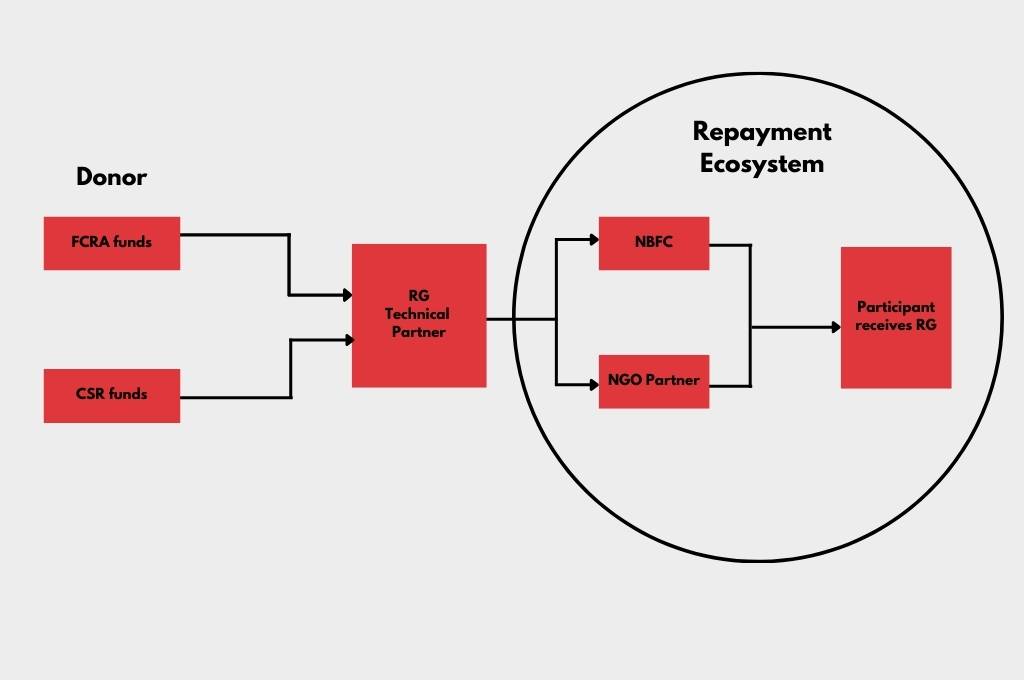

Donors who are interested in adopting returnable grants as a feature in their projects onboard a technical partner, who designs and structures the returnable grant, provides performance management support, and identifies the donor’s choice of recipients. The criteria for selection are as follows:

- First-time participants who are in need of capital, and can be introduced to the credit ecosystem through the returnable grants model

- Potential ability of selected participants to repay as a cohort

- Existing engagement or relationship with nonprofit partners, to understand if the returnable grant can be a good layer on other interventions

Returnable grants allow money to be directly credited into the participants’ accounts or given out as cash equivalents such as vouchers. This process is supported by nonprofit organisations or non-banking financial company (NBFC) partners. Once a returnable grant is repaid, it is circulated back into the repayment ecosystem to support additional participants with similar needs.

NBFCs, given their expertise in lending to large segments of the population, play a key role in fund management for participants, while nonprofit partners are able to leverage their connection with communities to identify participants.

Administration costs on returnable grants are variable as the grants are customised to suit the needs of the cohorts. These costs are in the range of 5-15 percent and determined by a few key criteria, including the size of the participant cohort, geographical spread, the cost of resources required to encourage nudges and manage operations with regard to disbursements and repayments, and the ability to recycle the amount multiple times over.

During difficult times, we have seen that participants have relieved financial pressures by investing the returnable grant into working capital or skilling for livelihood improvements. Moreover, repayments aid in building their credit worthiness, thereby helping them move slowly from informal to formal credit systems.

This structure has enabled vulnerable communities that were affected during the pandemic to access credit when they needed it most and repay it at a time that did not further compromise their financial situation. Additionally, it instilled a pay-it-forward attitude, encouraging them to help others in similar situations.

An innovative approach to funding CSR projects

Even before the pandemic, it was estimated that more than USD 500 billion of private capital was needed to achieve India’s sustainable development goals by 2030. It is critical that CSR, philanthropic, and government spending be applied even more strategically to deal with the pandemic’s effects and help with long-term recovery.

The returnable grant is one such option that can facilitate the creation of funding structures that are more focused on outcomes. One such intended outcome is for participants to reach a stage where they can earn enough income to be able to afford working capital expenses on their own. In certain cases, participants are able to expand their business or increase their sales through the initial returnable grant support and move towards accessing larger loans from formal institutions.

In our experience, we have noted that it is especially suited for accelerating livelihoods. The best examples of such use have been demonstrated by micro-entrepreneurs and informal workers, who have used it as working capital, or to facilitate reskilling and enhance their income levels.

We have seen several corporates adopting returnable grants as a CSR-compliant instrument to complement their traditional grant-making. Godrej, Arvind Ltd, S&P Global, IIFL Wealth Foundation, Claris/Brihati Foundation, and Vinati Organics are some of its early adopters. They have used it across various cause areas, including agriculture and skilling, because returnable grants have given them an opportunity to impact a greater number of people with the same quantum of grants.

This ability to scale impact per amount spent has been demonstrated by the high repayment rates of the returnable grant (97 percent) across more than 14,700 participants (farmers, street vendors, micro-entrepreneurs, persons with disabilities, and beauty entrepreneurs).

However, the biggest misunderstandings regarding the returnable grant are generally centred around compliance from an FCRA and CSR lens.

Compliance from an FCRA lens

The government established the Foreign Contribution (Regulation) Act, or FCRA, to regulate the acceptance and utilisation of foreign contributions or foreign hospitality by specific individuals or associations. This applies to foreign funds from foreign donors (foundations, bilateral agencies, multilateral agencies, HNIs, etc.) or transactions from non-local bank accounts. Here’s how the returnable grant is FCRA compliant:

- It adheres to the FCRA’s guidelines and falls within the ambit of an economic and social programme under Section 11(1) of the FCRA, 2010.

- It is not sub-granted but made available for recipients through trusted partners such as NBFCs.

- Participants pay back the partners, who then grant the money to other deserving participants. The money is never repatriated to funders and continues to rotate within the beneficiary ecosystem.

- It is legitimately and legally recorded as utilised or spent for the project within the community ecosystem, and is not repatriated to the donor. Instead, it is recirculated within the ecosystem and utilised further to provide more financial aid for the community, thus maximising its outreach and impact.

Compliance from a CSR lens

CSR regulations apply to corporates registered under the Indian Companies Act. Here’s how the returnable grant is CSR compliant:

- It can be used as a means to manage activities that are part of the Schedule VII list. Returnable grants can be categorised under Schedule VII of the Companies Act, 2013, and are considered eligible for CSR spend/expenditure.

- Funds deployed as a returnable grant cannot be returned to the donor, since this would violate the previous reporting as an expenditure. The funds are instead recirculated within the beneficiary ecosystem to provide more financial support.

- Where the company is concerned, when a grant is received by the first set of beneficiaries, it is deemed to have been utilised and complies with the company’s CSR obligation.

- Money returned by the beneficiaries is circulated within the ecosystem and tracked to provide inputs or until the funds are deflated.

The returnable grant is a community-centric, and compliant financial instrument that enables the maximisation of CSR spends’ impact. And although not a silver bullet, the returnable grant gives us a toolkit for collaboration and has the potential to bring large numbers of Indians out of poverty with modest funds circulating back into the system to support others with similar needs.

—

Know more

- Read this article to learn how the post-pandemic burden of recovery can be distributed more equitably.

- Learn more about the work done by REVIVE Alliance, a blended finance facility and livelihood accelerator that is helping informal workers and micro-entrepreneurs thrive.

- Read this article to understand how access to alternative credit mechanisms during the pandemic enabled informal women workers to gain financial security.