What are Development Impact Bonds?

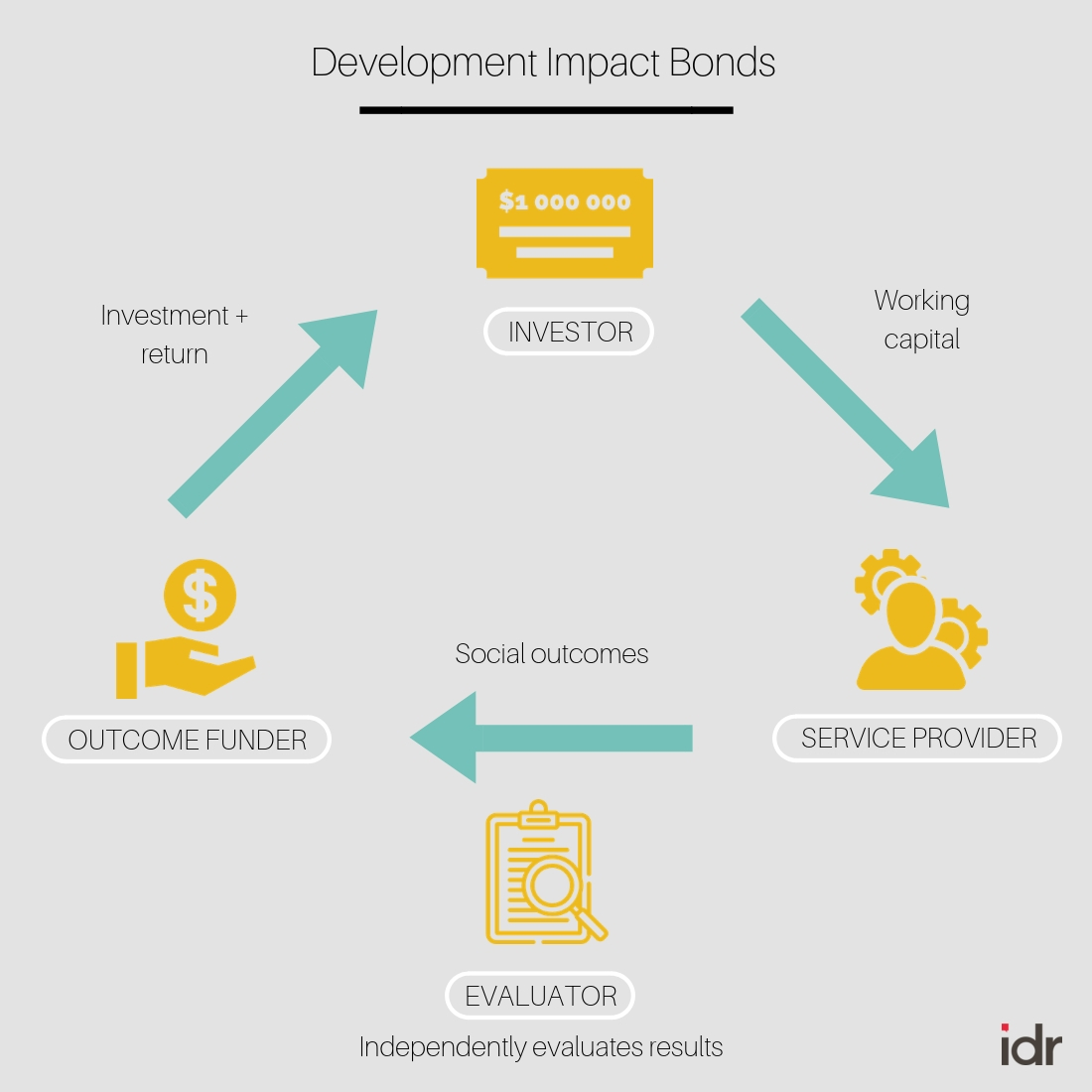

A Development Impact Bond, or DIB, is a results-based investment instrument that involves three parties: a private investor, an outcome payer, and an implementing partner/service provider. In practice, a DIB can have more than one of each type of partner. The private investor—usually a fund or group of investors—gives money to carry out a development project that promises certain social outcomes.

The service provider, usually a nonprofit organisation, is responsible for the project and its outcomes. If the outcomes are achieved, the investor is paid back the capital plus interest by the outcome payer, usually a philanthropic funder or organisation.

DIBs allow the focus in development aid to shift from inputs (e.g. the number of text books for students) to outcomes (e.g. an increase in students’ learning outcomes).

What’s the difference between DIBs and SIBs?

Social Impact Bonds are essentially the same as DIBs, except that the outcome payer in a SIB is the government. In other words, if the target outcomes are achieved, the investors are repaid by the government instead of a philanthropic organisation.

There are many incentives for the government to enter into such a public-private partnership. Under SIBs, public funds are directed towards projects that aim to show definite results. The risk of the investment is not borne by the government alone, but is spread across stakeholders. The contingency of achieving certain social outcomes also creates greater accountability among them.What does it cost to run a DIB?

The cost of a DIB depends on the project specifics and the target outcomes. Apart from the direct costs of the project, there are administrative costs, technical assistance and legal fees, among others. Because DIBs are a relatively new concept, these costs tend to be on the higher side. Data from Instiglio, an organisation that has played the role of a project manager for many impact bonds globally, suggests that there can be a lot of variability in costs. There are bonds that have cost under USD 1 million, and others that cost USD 8-10 million.

There are also several non-monetary costs associated with DIBs, especially for the service provider. These could include time spent by the leadership on oversight, and by key personnel within the organisation on managing multiple partners. Though DIBs are still a nascent concept, in the future as the concept matures, if a service provider fails to meet outcomes there could be costs to its reputation as well.What happens if results are not met?

The consequences of the service provider not meeting targets can vary according to the terms negotiated at the design stage. Typically, the outcome payer pays back the risk investor, but without any return, or with a certain percentage of the capital forfeited.

Sometimes, payments are made on a sliding percentage scale. For instance, if 90 percent of the results are met, 85 percent of the working capital will be paid back by the outcome funder; if 80 percent of the results are met, only 70 percent of the capital will be paid back, and so on.Who are the different stakeholders involved in a DIB?

There are four key players involved in a DIB:

1. Service provider: The development sector organisation or nonprofit that actually carries out the project and aims to achieve some set targets.

2. Investor/Risk investor: An investor or organisation that provides upfront capital to the service provider to carry out the project and achieve the targets.

3. Outcome funder: Usually a philanthropic organisation that pays back the original principal plus a return to the investor, if the targets are met.

4. Evaluator: An independent organisation that evaluates and validates the work of the service provider.

Apart from these, a DIB could also have a project manager that oversees the entire process: helping the service provider manage their performance and resolving any disagreements or conflicts between parties, among other things.

When did this type of investment instrument first enter development practice?

The first SIB was launched in 2010 by Social Finance UK. Social Finance raised approximately USD 8 million from 17 trusts and foundations to reduce reoffending among short-sentenced offenders leaving Peterborough prison. The investor was a group of several trusts and foundations, and the outcome payer was the Ministry of Justice, UK. The project was successful as it surpassed its predetermined outcomes. Since then, about 108 impact bonds have been contracted globally.

SIBs were more recently adapted into DIBs by replacing the government with external donors. This alteration has worked well insofar that in countries where the government may be reticent to enter into such an agreement, a private foundation can step in to play that role.When did India have its first DIB and what was the result?

In the year 2015, the first DIB in India was launched with the nonprofit Educate Girls as the service provider, UBS Optimus Foundation as the investor, and Children’s Investment Fund Foundation as the outcome payer. UBS invested a total of USD 270,000. IDinsight was the evaluator, and Instiglio oversaw the entire project. The project covered 166 schools in 140 villages in the district of Bhilwara, Rajasthan.

The target outcome for this three-year long DIB was two-fold:

1. To increase enrolment of out-of-school girls in standards 2-8

2. To increase learning outcomes in literacy and numeracy for children in standards 3-5

According to the final evaluation report by IDinsight, Educate Girls surpassed both its targets by 116 percent and 160 percent respectively. A total of 768 girls were enrolled in school and the learning gains for the schools in which Educate Girls intervened were 28 percent higher than in the ones they did not.Why is there so much debate around DIBs?

One of the reasons why organisations prefer DIBs is that the service provider gets working capital upfront, and does not have to fundraise continuously. Often, projects are funded by a few donors, each with different conditions and demands, making implementation and reporting more challenging for the nonprofit. Because the upfront capital in a DIB is unrestricted (i.e. the service provider has autonomy over how it chooses to spend that money to achieve its outcomes), there is greater flexibility and less effort required to manage a diverse pool of funders. That said, the service provider does have to spend time and effort on managing the DIB, which is a complicated and resource-intensive process.

A challenge with DIBs is their high reliance on data. Since the final payout is dependent on what the data shows, there’s little room for error with data collection and quality. This also makes the process more expensive. Sometimes data is collected not just from the intervention areas, but also from areas that were left untouched—a control group—so as to make a comparison and assess the impact of the DIB. On the flip side, because a DIB is closely evaluated at different stages, there is greater transparency about the project and its outcomes, and therefore, greater accountability.

At times a conflict of interest might also arise, for instance, regarding who pays the project monitor. If the outcome payer bears this expense, it’s in their interest to evaluate conservatively. But if the working capital provider is paying, the aspiration would be that the results to show that targets were achieved. Moreover, there’s the probability that if the project appears unlikely to achieve its outcomes, efforts will be increased significantly to ensure that everybody wins. One could argue that this creates an ‘artificial’ environment that may be difficult to replicate in a non-DIB setting, calling into question the true scalability of such an exercise.

A study by GO Lab suggests that though evaluations of impact bonds may determine if results were achieved, they fail to prove whether they were achieved because of the SIB approach, or whether the same results could have been achieved in a more conventional setting as well.How have DIBs performed globally? Have they proven to be an effective tool for development impact?

Thus far, two DIBs have been completed and evaluated worldwide. There are others at various stages of design and implementation. Apart from the education-focused one in India, Peru has had a DIB on sustainable coffee and cocoa production. The final evaluation of the project said that most of the targets were met.

A report by Brookings Institution assessed the performance of the first 38 SIBs globally. It found the following trends–more efficient and effective delivery of services; the development of strong monitoring and evaluation services; and higher degrees of collaboration.

The report also highlighted a few shortcomings. While impact bonds are said to drive innovation, most of the 38 SIBs evaluated were based on well-established models. Moreover, there isn’t enough evidence to suggest that DIBs encourage private investment in social projects, because the investors’ money is finally paid back by the government or a philanthropist. We are also yet to see if interventions through SIBs have sustained impact on the lives on beneficiaries.

Saahil Kejriwal contributed to this story; inputs and insights from Divya Pamnani.