Public scheme, private risk

In May 2020, the Gujarat government announced the Atmanirbhar Gujarat Sahay Yojana (AGSY)—a scheme that offers loans of up to INR one lakh at two percent to small businesses, individual skilled workers, and labourers in urban areas.

In a rare move, the government looked beyond banks and large financial institutions and reached out to smaller institutions such as credit cooperatives, which are owned by and serve financially poor households. They asked entities like Mahila Housing Trust (MHT), of which I am the director, to extend small-ticket loans to small businesses in the informal sector, since we work closely with them.

Meanwhile the state government has been advertising this package aggressively, and the public messaging is that the government is going to give out cheap loans. Our borrowers, therefore, expect to get a loan that would have typically been offered at a rate of 15 percent, almost free of interest.

The reality however is slightly different

According to the state’s guidelines, these loans have to be offered at an interest of eight percent; of this the borrower pays an interest of two percent while the remaining six percent will be subsidised by the Government of Gujarat government.

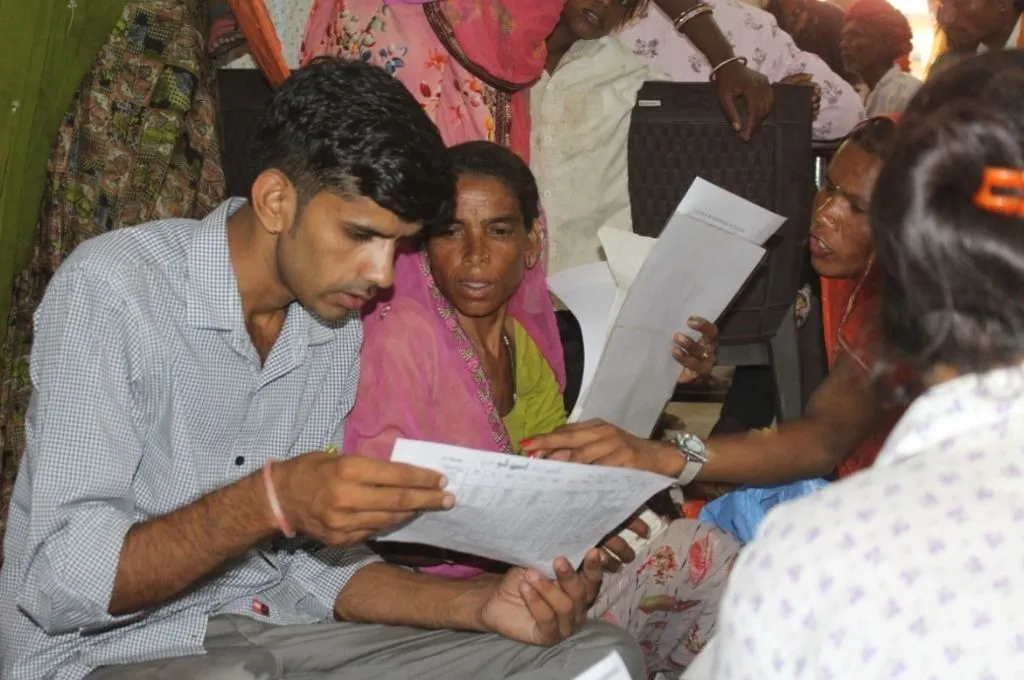

The government expects lending institutions like ours to go out and campaign with these small informal entrepreneurs, help them fill out the loan forms, and give them the loans. We then have to send this data to the government.

The problem is that while the package is being marketed as a government scheme, the actual funds are coming from the lending institutions. The government is not providing the financial institutions with any capital to on-lend. The institutions are expected to offer subsidised loans out of their own funds. The government will merely pay the difference between the market rate of loans and the subsidised rate at which it has been given, provided there is no default on that loan, or overdue.

So, for instance, even if the institution’s usual lending rate is 15 percent, it will have to offer these loans at eight percent. The borrower will pay back at the interest rate of two percent while the government will pay the difference of six percent to the financial institution, provided the street vendor pays back her loan.

This is causing problems

Because people think they are receiving a sarkari (government) loan, they also think that they do not have to pay it back. The perception is sarkar ki loan hain, to maaf ho jayega kyunki sarkar itni loan maaf kar deti hain. (In all likelihood, the government will waive off the loans like they have done with many other loans in the past.)

Second, financial institutions are bearing the risk. Smaller institutions like credit cooperatives do not have sufficient capital of their own or even working capital to give loans at such low rates. We bear the risk. Moreover, in a cooperative credit society, much of the capital comes from poor households. We on-lend their savings. If borrowers don’t pay back, it is the community’s capital that will be wiped out.

Bijal Brahmbhatt is currently the Director of Mahila Housing SEWA Trust (MHT).

—

Know more: Understand why COVID-19 relief should include the needs of ‘missed communities’.

Do more: Connect with the author at outreach@mahilahsg.org to understand more about and support her work.