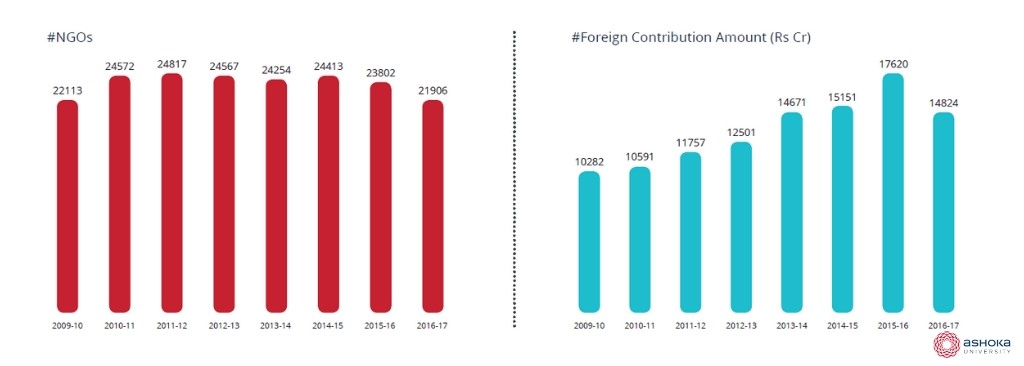

In year 2015-16, foreign donations worth INR 17,620 crore were made to 23,802 nonprofits in India. This figure was 16 percent higher than the previous year’s figure. In the same year however, some 10,000 FCRA registrations held by nonprofits were cancelled by the government.

FCRA refers to the Foreign Contributions (Regulation) Act, a law in the Indian Constitution that looks at the inflow of philanthropic money from foreign contributors, specifically to nonprofits in India1.

In recent years, FCRA has become an important part of the public discourse, and foreign donations have been getting an increasing amount of attention from both the media and the government. Despite this, there have been instances where conflicting data points have been quoted by various entities.

To address this problem of inconsistent and inaccurate data, the Centre for Social Impact and Philanthropy (CSIP) at Ashoka University commissioned research that uses a quantitative approach, and analyses publicly available data on financial flows into the sector. Here are some highlights from their report with respect to foreign funding to the sector.

Foreign funds have fallen but not to the extent stated by the government

In 2016-17, the number of nonprofits with FCRA registration declined eight percent (by 1,896) to 21,906. During the same year, the total foreign funds received by them dropped 16 percent from INR 17,620 crore to INR 14,824 crore.

Related article: CSR giving in India is heavily skewed

Source: Centre for Social Impact and Philanthropy

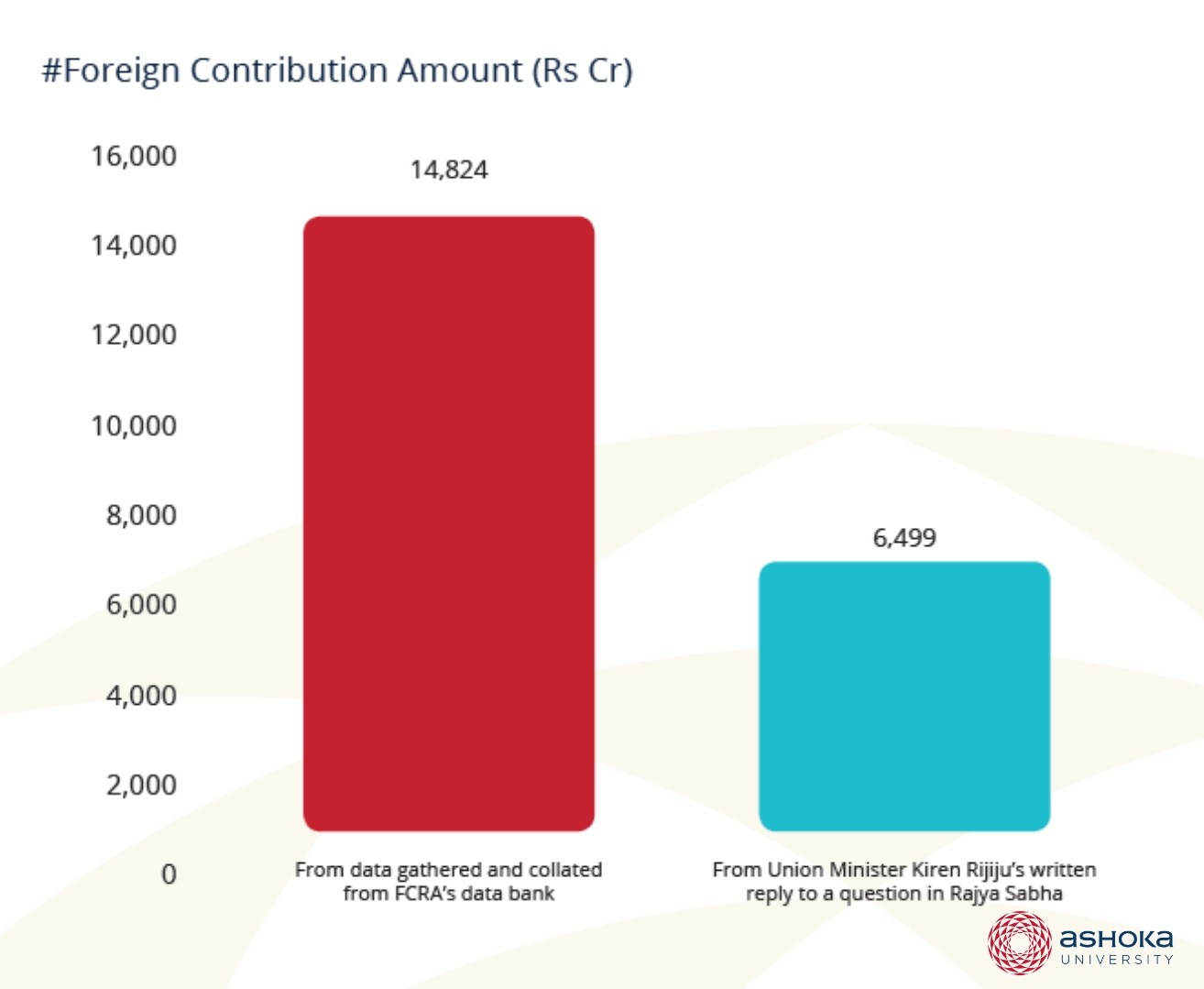

This is in contrast with the figures stated by the Minister of State for Home Affairs, Kiren Rijiju. He said that foreign donations under FCRA had dropped from Rs 17,773 crore in 2015-16 to Rs 6,499 crore in 2016-17.

The compilation of individual nonprofit data scraped from the government of India’s FCRA database in the CSIP report showed the 2015-16 figure to be close to the government’s figure. However, the government’s 2016-17 stated figure was 56 percent lower than that highlighted in the report.

Source: Centre for Social Impact and Philanthropy

There is a difference between FCRA-registered nonprofits and FCRA registration numbers

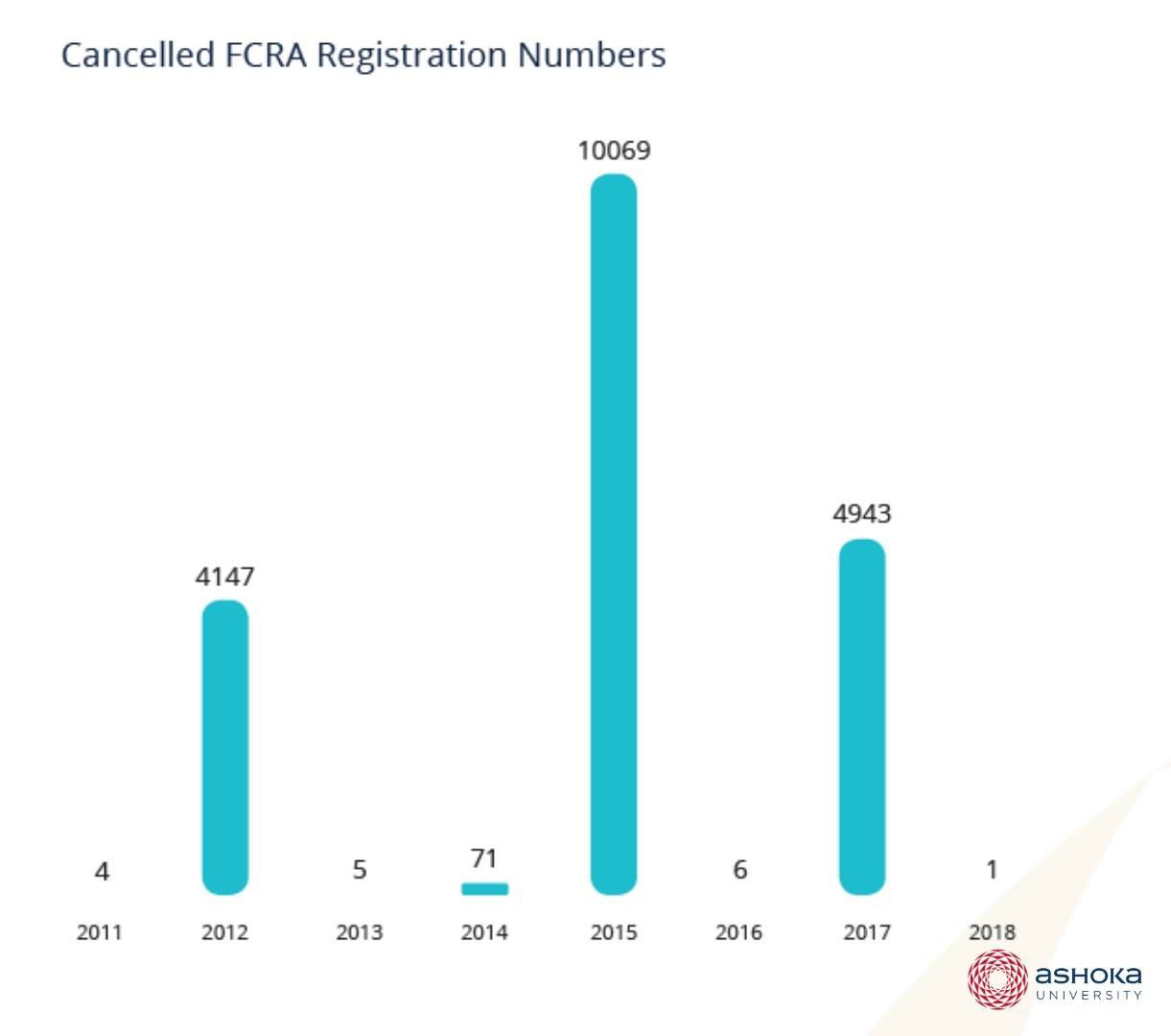

In December 2017, Kiren Rijiju had said that registration of 18,868 nonprofits had been cancelled during the period 2011 to 2017, for FCRA violations. The CSIP report shows three waves of cancellations of FCRA registration numbers in the period, the main stated reason being failure to file annual FCRA returns.

Source: Centre for Social Impact and Philanthropy

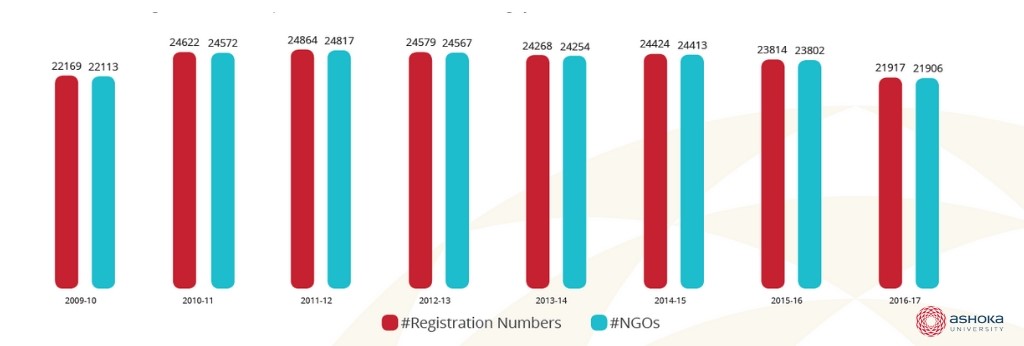

Here, it is important to differentiate between ‘FCRA-registered nonprofits’ and the ‘FCRA registration number’. The former refers to organisations that are authorised to receive foreign donations. The latter is a numeric ID that is assigned to an FCRA-registered nonprofit. However, this ID has not been unique. Over the years, nonprofits have acquired multiple registration numbers. Hence, a single nonprofit might have several FCRA registration numbers.

The FCRA registrations that were cancelled mostly pertained to duplicates.

Many of these ‘duplicate’ registration number had been inactive, and a significant part of the cancellation spree has been of these. Therefore, when we say that ‘x’ number of registrations have been cancelled, it does not mean that ‘x’ nonprofits are now unable to receive foreign donations.

This is supported by the data from the FCRA data bank. In most years, the number of FCRA registrations and unique nonprofits in the FCRA data bank is largely similar. This implies that the FCRA registrations that were cancelled mostly pertained to duplicates.

Source: Centre for Social Impact and Philanthropy

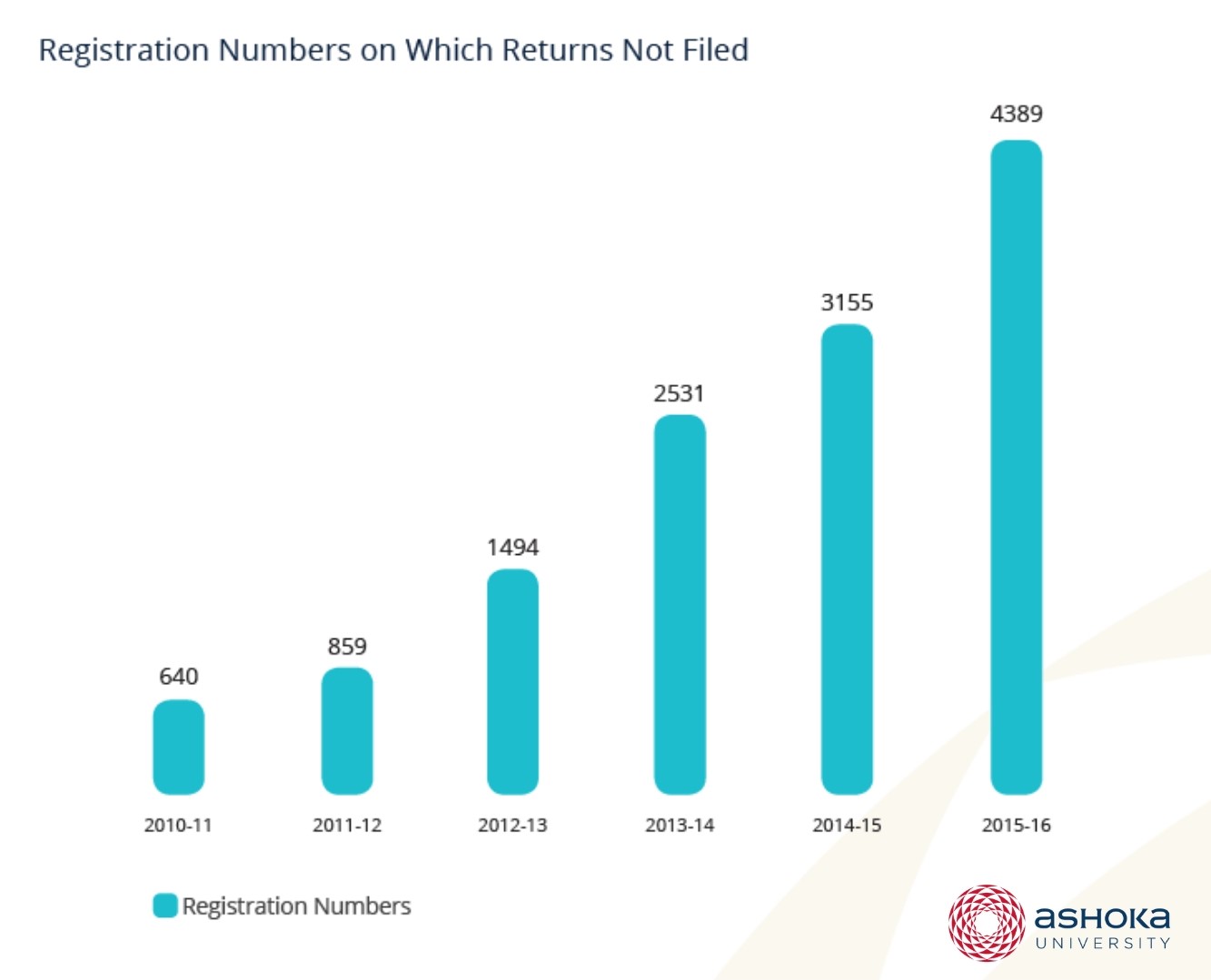

According to another data set in the FCRA data bank, between 2010-11 and 2015-16, there were 13,068 FCRA registration numbers for which nonprofits had not filed annual FCRA returns. This matches the volume of FCRA cancellations seen during this period, and supports the reading that the en masse cancellations are primarily a result of the weeding out of multiple registration numbers.

Source: Centre for Social Impact and Philanthropy

Five states accounted for nearly half the foreign donations received

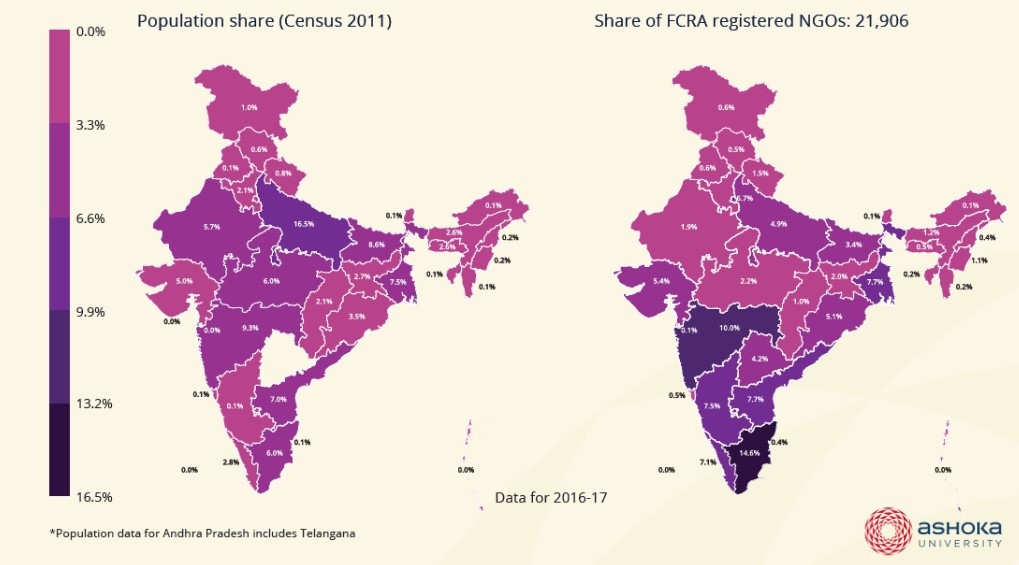

FCRA-registered nonprofits are largely located in western and southern India. Of the 21,906 such nonprofits in 2016-17, about 47 percent was located in just 5 states: Tamil Nadu, Maharashtra, Andhra Pradesh, Karnataka, and Kerala. For each of these states, the share of FCRA-registered nonprofits is higher than their share of population.

Source: Centre for Social Impact and Philanthropy

For each of these states, the share of FCRA-registered nonprofits is higher than their share of population.

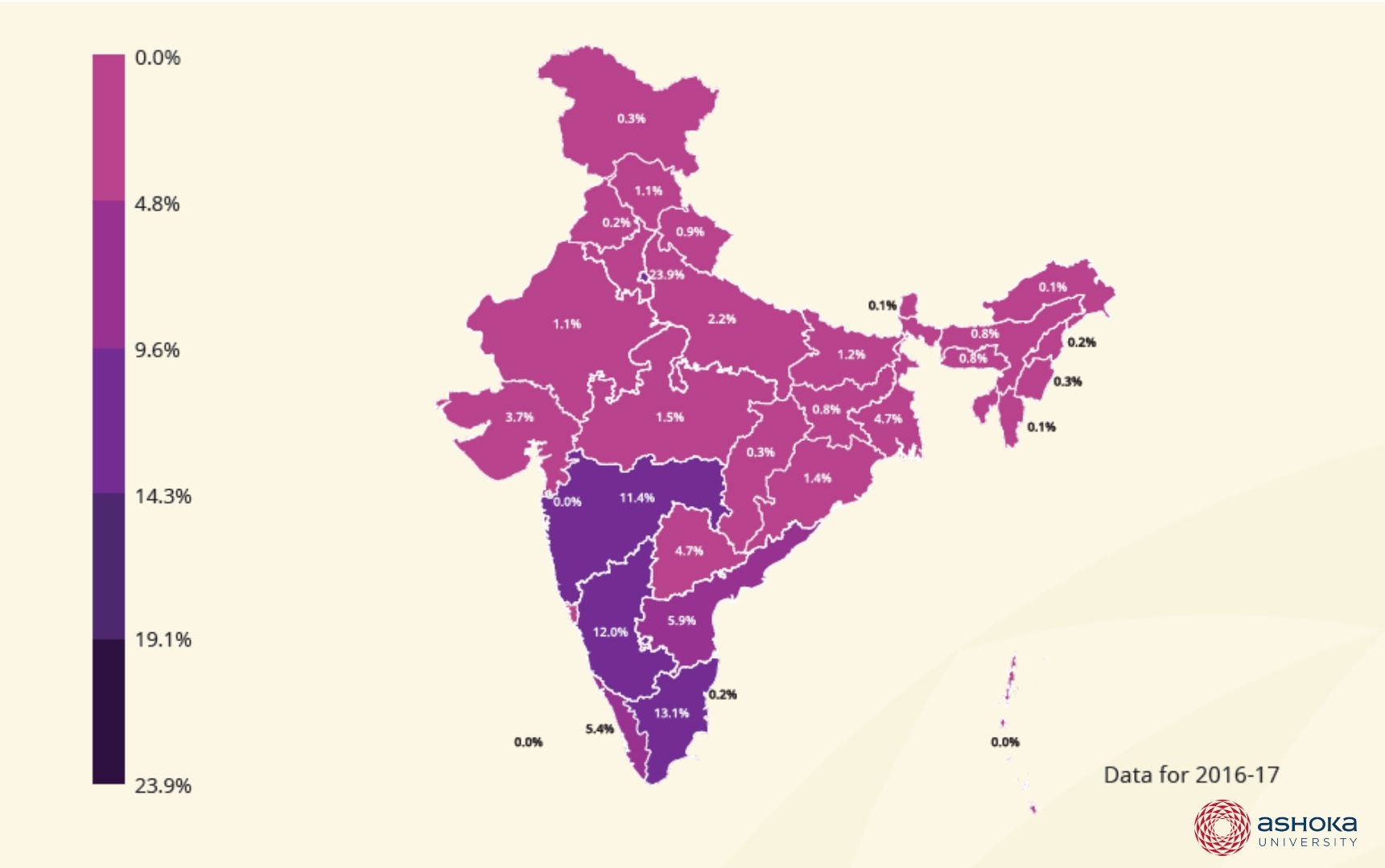

Of the INR 14,824 crore received by FCRA-registered nonprofits in 2016-17, 59 percent was disbursed in Delhi, Tamil Nadu, Karnataka, and Maharashtra, which together have 38 percent of all FCRA-registered nonprofits, and only about 16 percent of the country’s population.

Source: Centre for Social Impact and Philanthropy

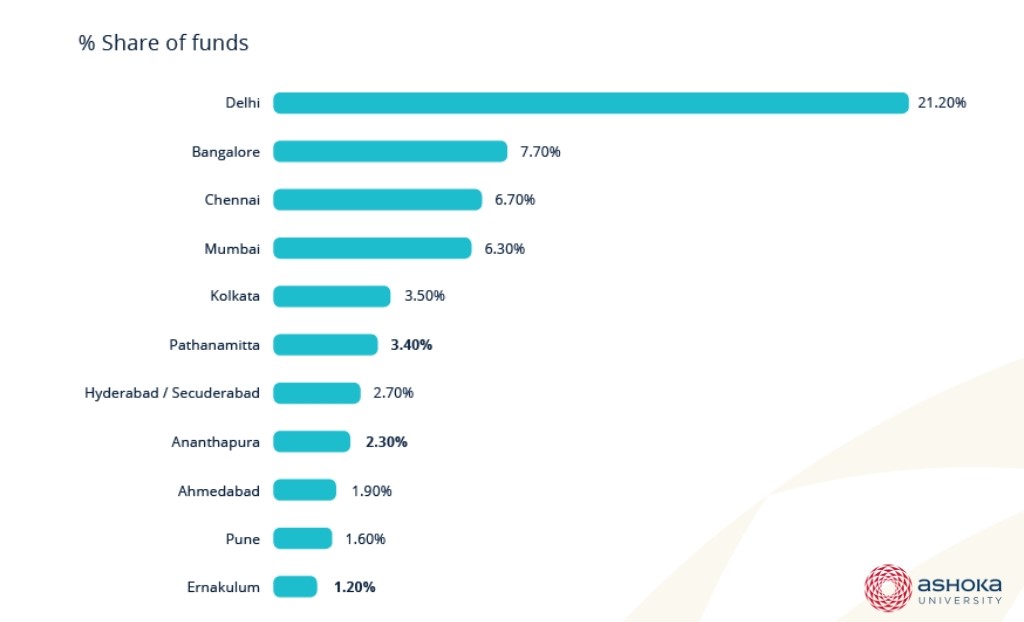

If we look at the share of foreign donations received in terms of cities/districts, India’s five big metropolitan cities received the highest share in the last eight years.

Source: Centre for Social Impact and Philanthropy

What seems counter-intuitive is that among the top 11 cities/districts, there are three—Pathanamthitta, Ananthapur, Ernakulam—that lead in neither population nor economic activity.

A few nonprofits received a disproportionately large amount of donations

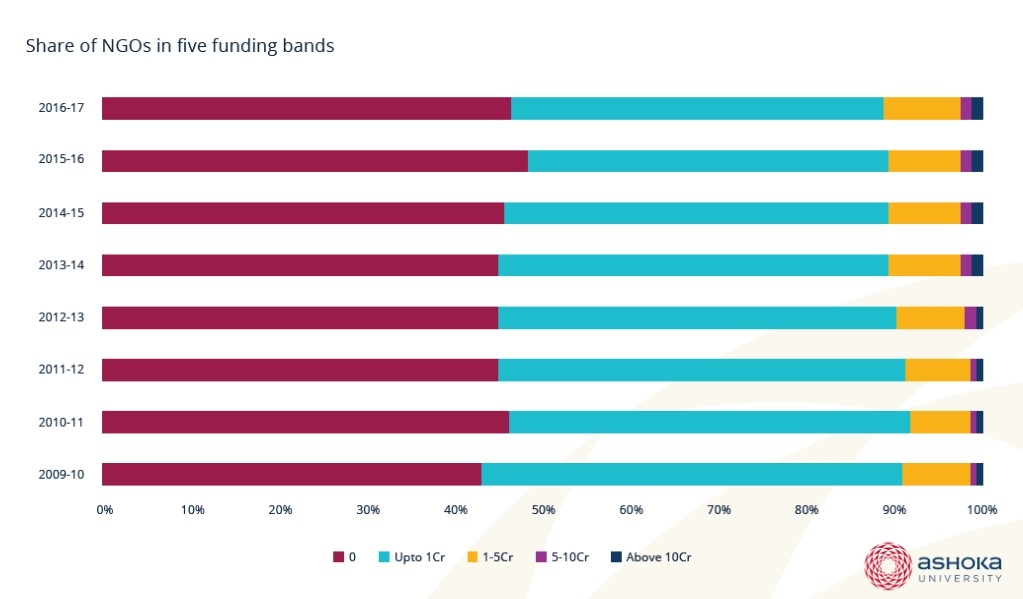

In each of the last eight years, on average, 45 percent of the FCRA-registered nonprofits did not receive any foreign donations. A further 42 percent of registered nonprofits received foreign donations up to INR 1 crore in a year. Only 10-12 percent of FCRA-registered nonprofits received funding above INR 1 crore in a given year.

Related article: IDR Shorts | Philanthropy’s role in rights-based advocacy

Source: Centre for Social Impact and Philanthropy

On average, 45 percent of the FCRA-registered nonprofits did not receive any foreign donations.

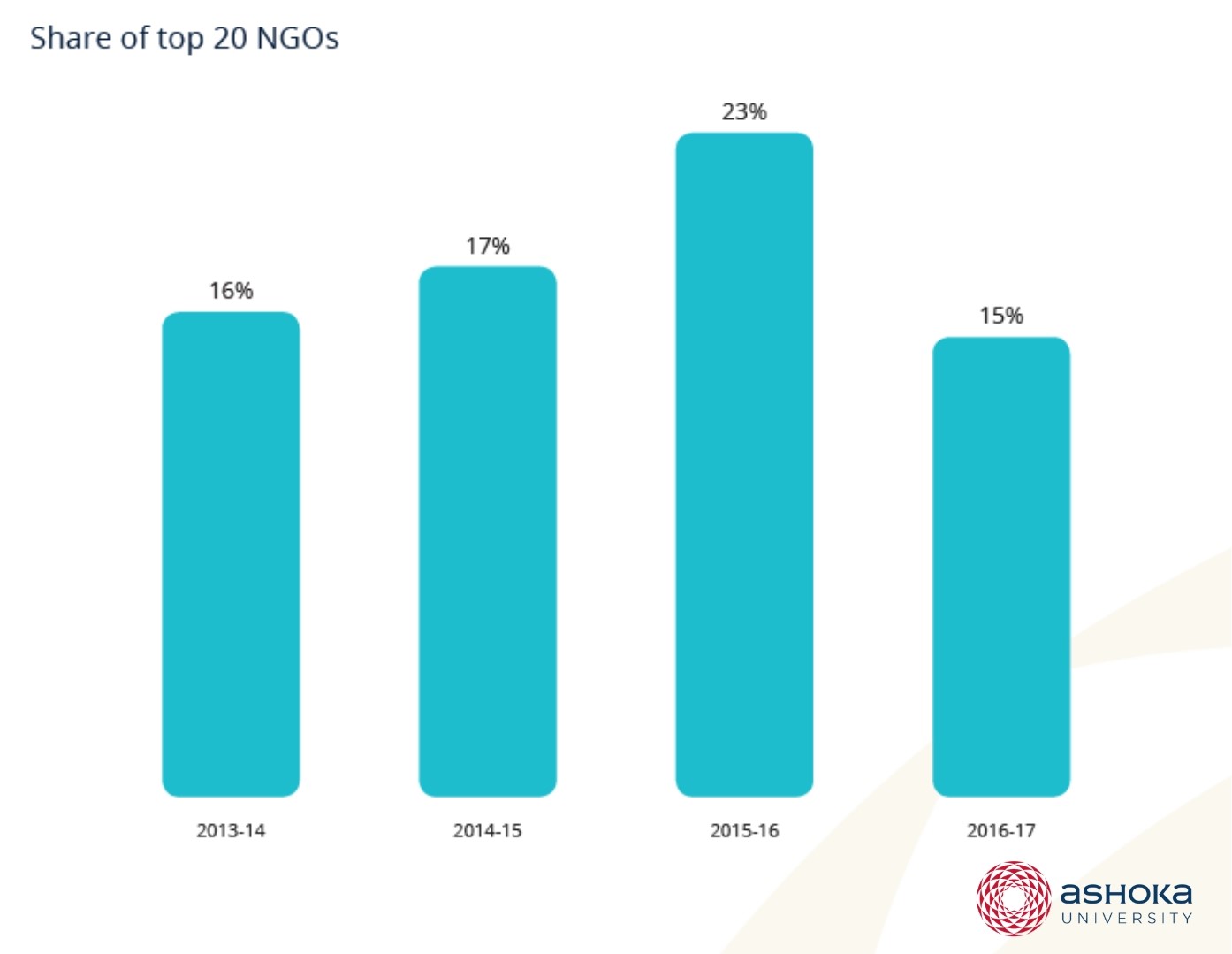

The figures are more striking when we look at the top 20 FCRA-registered nonprofits. In 2016-17, they were around 0.1 percent of the total registered nonprofits but their share of foreign donations was 15 percent of the INR 14,824 crore that came into the country. This trend has remained largely consistent over the last four years.

Source: Centre for Social Impact and Philanthropy

Foreign funds came mostly from institutional donors

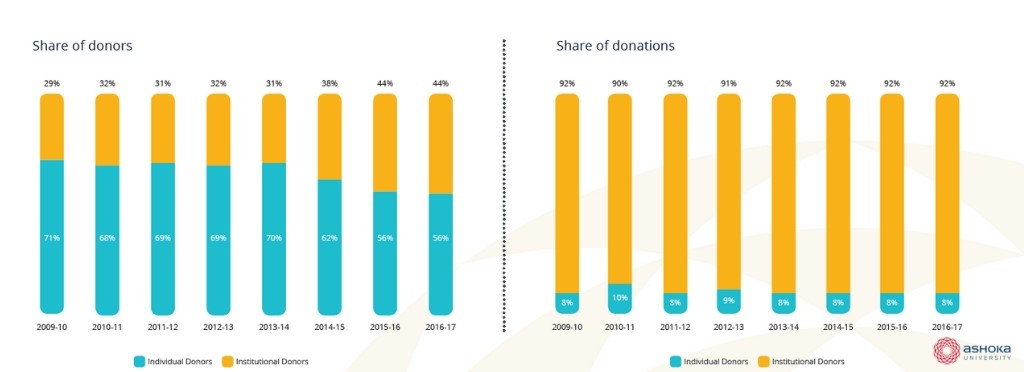

The ratio of individual and institutional donors (by number) has been around 60:40 in the last eight years. However institutional donors have accounted for 92 percent of the foreign funds received.

Related article: Nonprofit flow chart | Will I get my FCRA licence?

Source: Centre for Social Impact and Philanthropy

While the Government has made an effort in recent years to improve transparency in the sector by making some data publicly available, focused efforts need to be made to improve the quality of data that is collected, stored, and managed by the Government. One way to do this is by introducing a common identifier such as a PAN Number. A unique identifier across data sets will enable collation and comparison, and make analysis more meaningful.

Availability of more accurate data on FCRA and foreign philanthropy will ensure that the discourse around it is more informed and strategic, and that all the stakeholders have a better understanding of the sector.

- FCRA requires nonprofits to register with the government, and gain authorisation, to be able to receive donations from foreign sources. It also requires them to file a statement of returns each financial year. This includes details of how much foreign donations the nonprofit received, from whom, and how much of it was used and unused.