Crowdfunding as a mode of raising money has become extremely popular, especially over the last year with many people giving donations towards COVID-19. However, one must be aware of the tax implications and the law while doing so to ensure that most of the money reaches the cause it was intended for and that you do not fall foul of the law. This is important for both fundraisers and donors to keep in mind.

You might have read about Rana Ayyub and Sonu Sood getting into trouble with the tax authorities a few months ago for the donations they collected via crowdfunding platforms. These two instances have the following lessons for individuals who plan to use crowdfunding platforms to raise money, and the donors who give to these fundraisers. They can be broadly categorised as follows:

- Taxation of money raised on crowdfunding platforms

- Regulation around FCRA donations

Taxation of money raised on crowdfunding platforms

Rana Ayyub raised INR 2.70 crore in donations, and had to pay taxes amounting to INR 90 lakh. In essence, one-third of the funds that people donated went towards taxes and not the intended cause.

This is very important for all individual fundraisers to note: If you collect donations in your account you have to pay income tax on the same, not to mention the increased scrutiny of the Income Tax department for receiving money in your bank account in the first place. Further, when you give this money to the recipient, they too might have to pay income tax on the amount they receive, thereby making the donation subject to double taxation.

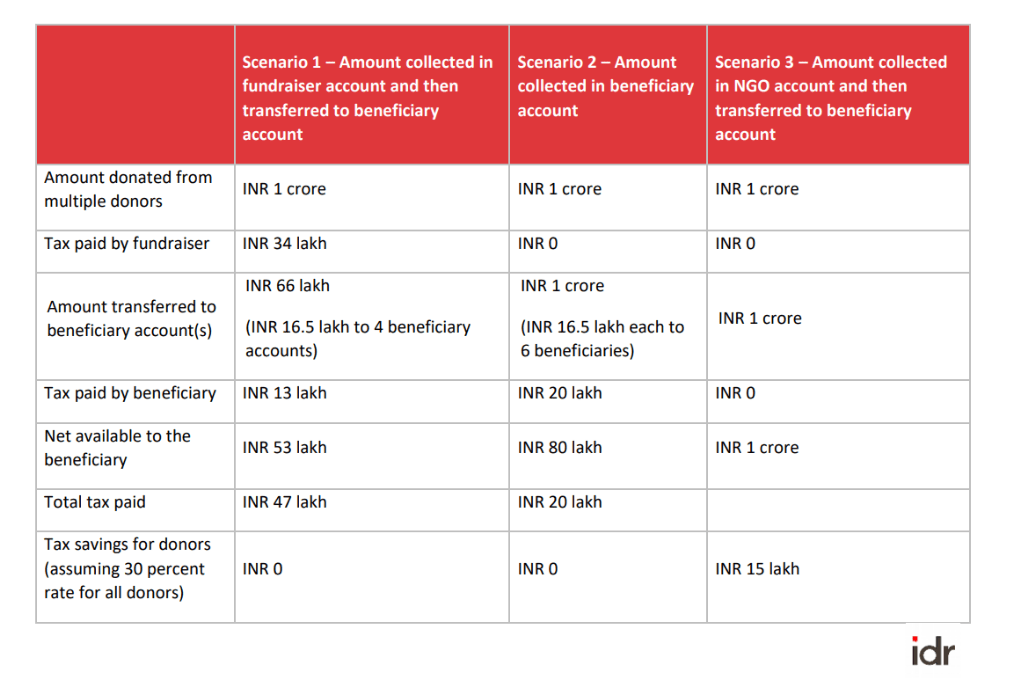

Let us explain this with 3 models.

Scenario 1—where an individual fundraiser raises money in their own account on behalf of another organisation or individual and then transfers that money to them—is the worst case.

The impact of taxes can be averted to some extent in scenario 2, where the fundraiser campaigns and raises money but donors give directly to the recipient organisation/individuals (in which case the first level of tax of 34 percent doesn’t kick in). In another version of this scenario, the crowdfunding platform on which the money is being raised transfers the money to the organisation, in which case again no money is lost to tax at the first level. This is what most crowdfunding platforms do. But this may not always be possible based on what the money is raised for—it could be raised for education of children, taking care of stray dogs, and so on.

A simple way to avert this issue is by finding a nonprofit that works in the area you want to raise money for, as outlined in scenario 3. Assuming the nonprofit has 12A and 80G tax exemptions, this model has two benefits:

- No taxation at the hands of the fundraiser as donations are collected by the nonprofit

- No taxation at the hands of the recipients as amounts transferred by the nonprofits are not subject to tax

Moreover, it has another big advantage—donors are entitled to tax savings of up to 50 percent on their donation. This means that if you donate INR 10,000 you can reduce your total taxable income by INR 5,000. This implies that if you are in the highest tax bracket of 30 percent, your tax liability will reduce by INR 1,500.

Tax savings for the donor and higher amounts for the recipients is a win-win situation for both the giver and receiver and is what you as a fundraiser should aim for.

Regulation around FCRA donations

An important point to note is that as an individual fundraiser, you are not allowed to raise donations from foreign citizens without having an FCRA certificate. FCRA—a law enforced by the Ministry of Home Affairs—regulates the inflow of foreign contributions or aid to India. So, while raising money, you must ensure that your crowdfunding platform does not allow any foreign citizen to donate to your campaign.

Things for fundraisers to keep in mind while raising money

- Find a nonprofit that can channel donations to the cause you would like to support, in order to maximise the amount reaching the nonprofit. If you are raising funds for an individual, you can use India Cares, a reputed nonprofit that provides this facility at a cost of 2–3 percent of the funds channelled. You can raise money through your preferred crowdfunding platform while selecting India Cares as the recipient of the donation.

- Ensure that the nonprofit has an 80G certificate. This will ensure that your donors get a tax benefit as well.

- It will help if the nonprofit has an FCRA licence, since this will allow friends and family overseas (and who are foreign citizens) to donate to the organisation as well. If the nonprofit does not have an FCRA licence, check with your crowdfunding platform to ensure that no foreign citizens are allowed to donate through this fundraiser. This is necessary to avoid being hauled up by the authorities. Indian citizens residing abroad, however, can donate in any currency.

Things for donors to keep in mind while contributing to fundraisers on crowdfunding platforms

- Ensure that the campaign is for a nonprofit: If you want most of your contribution to go to the final recipient, only donate to campaigns where the recipient is a nonprofit.

- Ensure that the nonprofit has an 80G certificate: If you would like to avail of the tax benefit, the nonprofit you donate to must have an 80G certificate. Most crowdfunding platforms will clearly mention this on the campaign.

- If you are a foreign citizen, ensure that the nonprofit or person you are contributing to has an FCRA licence: If they do not have an FCRA licence, they are in violation of the law to receive foreign contributions; this could land them and/or you in trouble, or your contribution may get refunded later.

To give you an example of how one can navigate fundraising via crowdfunding platforms: My batch at IIM Ahmedabad recently raised funds for a deceased classmate’s family. Given the nuances involved in raising funds on a crowdsourcing platform, we chose to undertake the fundraising in two parts. For Indian citizens, we asked people to donate through India Cares. Since it’s a nonprofit, its recipients didn’t have to pay taxes, and it allowed us—the donors—to receive 80G tax benefits. For many of our classmates who are now foreign citizens, we used another nonprofit—one with an FCRA certificate—to raise international funds and provide them tax benefits in the US. This dual fundraising approach helped us optimise for both Indian and foreign donors.

Crowdfunding platforms have evolved as a great way to raise money for various causes. Many times we are far too concerned by the 5–10 percent they charge, forgetting that raising money the wrong way can result in more than 30 percent of the amount not reaching the real recipients. So, raise money, but raise it wisely.

This article has been edited in parts specifically for a nonprofit audience. The original version was published on October 19, 2021 in Hindu BusinessLine.

—

Know more

- Read how first-generation students are successfully crowdfunding their education costs.

- Learn about the tax implications of your crowdfunded treatment for COVID-19.

- Get to know how online giving is changing philanthropy.