In 2021, investments in Indian impact enterprises exhibited strong signs of recovery and renewal after the debilitating effects of the global pandemic. Two hundred and ninety-four enterprises attracted approximately USD 6.8 billion in equity investments across 345 deals.

While the number of deals rose by only 5 percent compared to 2020, there was a 135 percent jump in total investment volume. The Impact Investors Councils’ (IIC) annual impact investment research report 2021 in Retrospect: India Impact Investment Trends highlights key investment trends across six sectors—climate, agriculture, education, tech4dev, financial inclusion, and healthcare. Here’s what 2021 looked like for impact investment in India.

Late-stage tech investments drove most of the growth in 2021

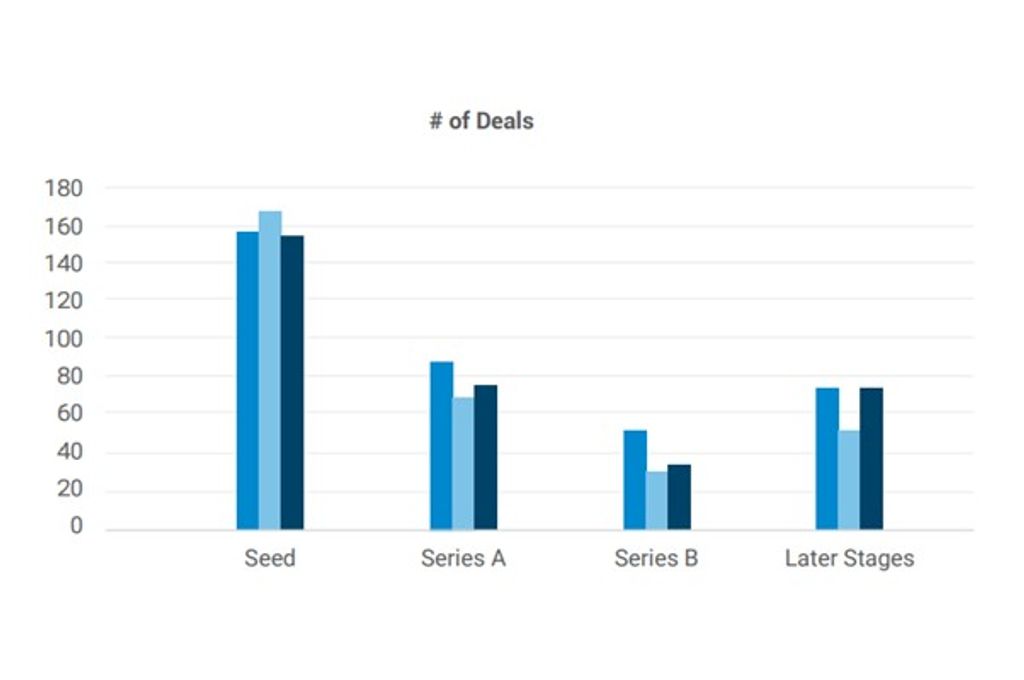

The post-pandemic growth in investments across sectors was the result of an increase in the number of big-ticket deals (greater than USD 100 million) in the later stages of funding. Our analysis shows that a disproportionate percentage of these investments went to a handful of enterprises—only 14 enterprises accounted for almost 60 percent of the total impact investment volume in 2021. This trend reflects investors’ comfort in funding established and proven tech-driven business models that have significant capital needs as they grow and expand their operations.

Climate tech emerged as a vibrant sunrise sector

Owing to the effects of climate change globally, investors have increasingly steered their attention towards Indian impact enterprises that focus on climate change mitigation, adaptation, and resilience. These enterprises’ potential to deliver disruptive climate tech solutions that cut across diverse sectors and industries is increasingly being recognised. Our analysis revealed that climate tech witnessed the highest number of deals across all sectors. The total investment volume in the sector reached an all-time high of USD 590 million in 2021—a 200 percent increase from 2020. This exponential growth has been driven by increasing early-stage innovation activity, which is reflected by the outsized share (65 percent) of seed-stage deals in the sector.

The next frontier of climate tech will lie in segments that are directly influenced by sustainable consumption habits. As more and more consumers desire products that do not contribute to climate change, greater impact capital will flow towards enterprises that focus on environment and natural resources, such as those that develop bio-packaging solutions for everyday goods. Similarly, waste management innovations that use deep tech to break down contaminants such as microplastics will also receive greater investor interest.

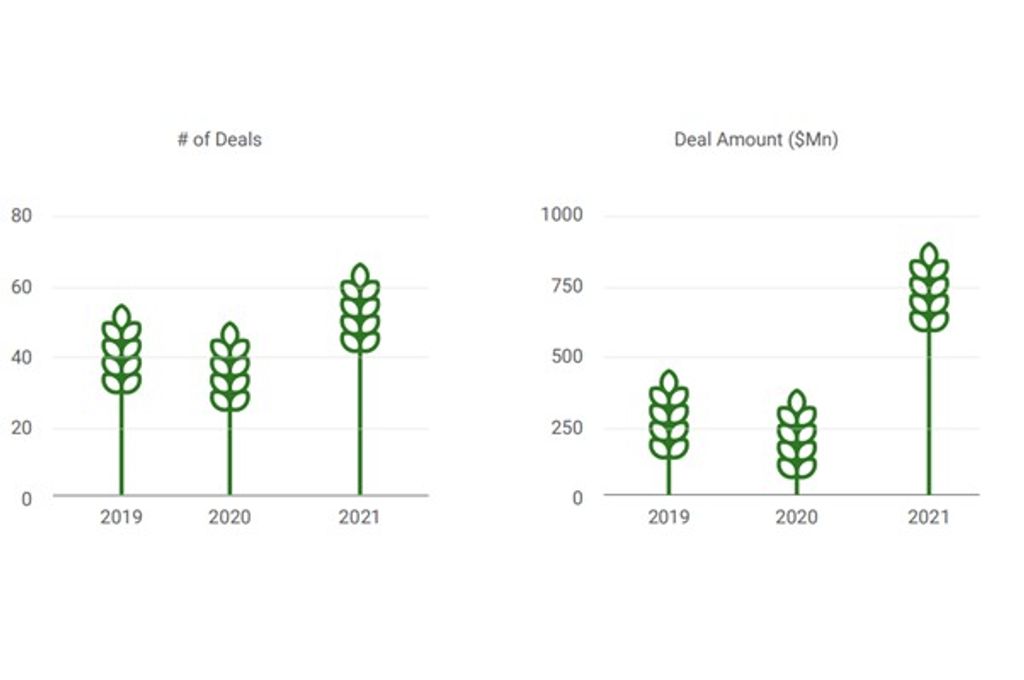

Agriculture continued to exhibit steady growth

Agriculture forms the backbone of India’s socio-economic fabric and is directly responsible for the employment and incomes of a majority of its workforce. Therefore, the sector is a key focus area for impact investors looking to balance financial returns with societal impact. This is reflected in the sector’s robust deal flow across the years. In 2021, the overall investment volume reached an all-time high of USD 889 million across 62 deals—an increase of more than 114 percent from 2020. We also saw signs of the sector maturing as capital moved away from the seed stages to the later stages with the objective of supporting the scaling up of agri-tech start-ups.

Market linkage platforms that provide farmers with online access to a variety of offline products and services continue to dominate the sector, attracting approximately 40 percent of the investment volume. Furthermore, technology start-ups that address pre- and post-harvest issues such as logistics and transport, food processing, and food safety and traceability received heightened investor interest.

Investments in financial inclusion rebounded strongly in 2021

Financial inclusion has been the traditional mainstay of India’s impact investing ecosystem. The sector has resultantly attracted almost half the entire impact capital flowing into Indian enterprises since 2017. While 2020 was a challenging year for financial inclusion thanks to the economic shocks induced by COVID-19, the sector rebounded strongly in 2021, with the total investment volume rising by 146 percent to USD 1.8 billion. Despite the sector’s robust pipeline of deals in 2021, its recovery largely resulted from the substantial increase in big-ticket investments (greater than USD 100 million) in growth-stage enterprises.

India’s digital revolution has been a key factor driving the radical transformation of this sector, which has evolved from a constrained, physical ecosystem to one where anyone can service their financial needs through their phones. This is particularly apparent in the small- and medium-enterprise finance space, with financial services being embedded within various value chains, including the agri-value chain and the fast-moving consumer goods (FMCG) value chain. Furthermore, we are also witnessing traditional lenders like non-banking financial companies incorporating digitally driven value-added services, such as insurance and savings, into their business models to better serve their borrowers.

2021 was a dynamic year for the tech4dev ecosystem

Technology continues to emerge as a driving force in India’s socio-economic development, be it through supporting micro, small, and medium enterprises (MSMEs) or providing rural Indians access to products and services once restricted to the metros. Investments in tech4dev-focused social enterprises rose to USD 1,298 million in 2021—a 224 percent jump from 2020. Despite the substantial spike in investments, the number of deals in the sector was lower than that in 2019 (49 in 2021 vs 60 in 2019). However, the sector has the potential to attract more capital in the short term by expanding support to a larger base of early-stage enterprises that bring B2B and B2C commerce and regional vernacular content (social media, audiobooks, e-books, etc.) to India’s underserved rural and peri-urban markets.

Boosted by the lockdowns and stay-at-home orders, enterprises offering local-language content attracted the most capital in the tech4dev space. Furthermore, after the success of B2C commerce in urban India, small towns are the new frontier for investors, as reflected by the rapid scaling up of social commerce enterprises such as Citymall. The pandemic has also pushed a large number of MSMEs to look for digital tools that can help them scale faster and become more productive and cost-efficient. Consequently, SME tech enterprises that digitise supply and improve quality of production received increased investor interest in 2021.

The pandemic sparked a renewed interest in healthcare

The adverse consequences of inequities in access to healthcare infrastructure became particularly apparent during the COVID-19 pandemic. This reinforced the need for affordable, quality, and accessible healthcare, particularly in low-income rural and semi-urban areas. There was subsequent renewed investor interest in the sector in India, but it was limited to very specific segments and stages of enterprises. The healthcare sector bounced back reasonably in 2021, with the total volume of investments increasing by 6x over the 2020 levels to USD 1.2 billion. However, the total number of transactions over the last three years remained flat. While the early-stage activity plummeted by almost half as investors looked to fund business models with an established proof of concept, late-stage activity contributed significantly to growth in the sector.

Segments with strong online components such as digital pharmacies, diagnostic chains, and primary care continued to receive disproportionate investor attention. For instance, digital pharmacies received almost 70 percent of the total impact capital in the sector in 2021. The current investment trajectory shows that investor confidence in digital health start-ups and healthcare delivery/clinic platforms is driven by technologies that improve accessibility in remote areas and foster business model innovation. However, the sector is yet to witness noticeable movement from seed to Series A—particularly in disruptive segments such as diagnostic devices, therapeutics, and other products that hold the potential to transform the healthcare sector and propel long-term meaningful social impact.

After its sharp initial growth, the education sector consolidated in 2021

The COVID-19 pandemic and the consequent nationwide school closures facilitated the rapid digitisation of learning and skilling platforms. In 2020, investment volumes in education almost doubled to USD 732 million, while the number of deals in the sector reached an all-time high of 58 during the same period. However, the sector observed only a 7 percent increase in overall investment volume in 2021, and the number of deals declined considerably (by 27 percent). The small uptick in investment volume was driven by a couple of large, individual late-stage deals that alone raised more than 50 percent of the total impact capital invested in the sector.

Going forward, the digitisation of India’s education sector is expected to continue as physical centres of learning increasingly embrace a hybrid model. As a result, investors are seeking new-age technologies that can further improve the quality of K–12 digital offerings. Simultaneously, more impact enterprises are striving to plug India’s skilling gap through employability platforms that train blue-collar workers and college students and connect them to the right employers.

Slow but growing momentum towards gender-lens investing

While a vibrant entrepreneurial ecosystem continues to underpin India’s growth trajectory in creating jobs and wealth, considerable gender gaps exist at multiple levels. Our initial analysis indicates that of the 597 impact enterprises that received equity investments across 2019, 2020, and 2021, only 130 were (co-) founded by women. These women (co-) founded impact enterprises raised a total of USD 2.3 billion across this period compared to the USD 14 billion raised by impact enterprises founded by men, reflecting a significant gender gap. The lack of a gender-inclusive perspective, especially in impact investments, is a missed opportunity not only to augment market returns but also to deepen social impact.

That being said, the recent return of gender to the fore of the investing landscape as a key mandate has been encouraging to witness. In 2021, women founders raised 22 percent of the total impact capital—a 5x jump from 2020 thanks to big-ticket investments in women-founded enterprises. Initiatives such as the 2X Challenge have propelled a variety of asset managers and other actors to actively incorporate gender considerations into their investment thesis and organisational strategies.

—

Know more

- Read this report to understand the Indian impact investment trends in 2020.

- Read this article to know more about how the ecosystem for climate tech start-ups in India can be strengthened.