In recent years, the idea of impact investing—the act of investing with the intention of generating positive social and environmental impact, alongside a financial return—has gained ground in India. According to the recent IIC-Asha Impact report, the Indian impact investing industry has reached more than 490 million people with a cumulative equity investment of USD 11 billion spread across 600 impact enterprises, over the last ten years.

Impact measurement and management (IMM) is a critical component of impact investing. As a concept, impact measurement is not new and has been prevalent in international development for decades, through the monitoring and evaluation component of social or environmental projects. However, the integration of IMM into an impact investor’s decision of whether to invest or not, is a fairly new construct.

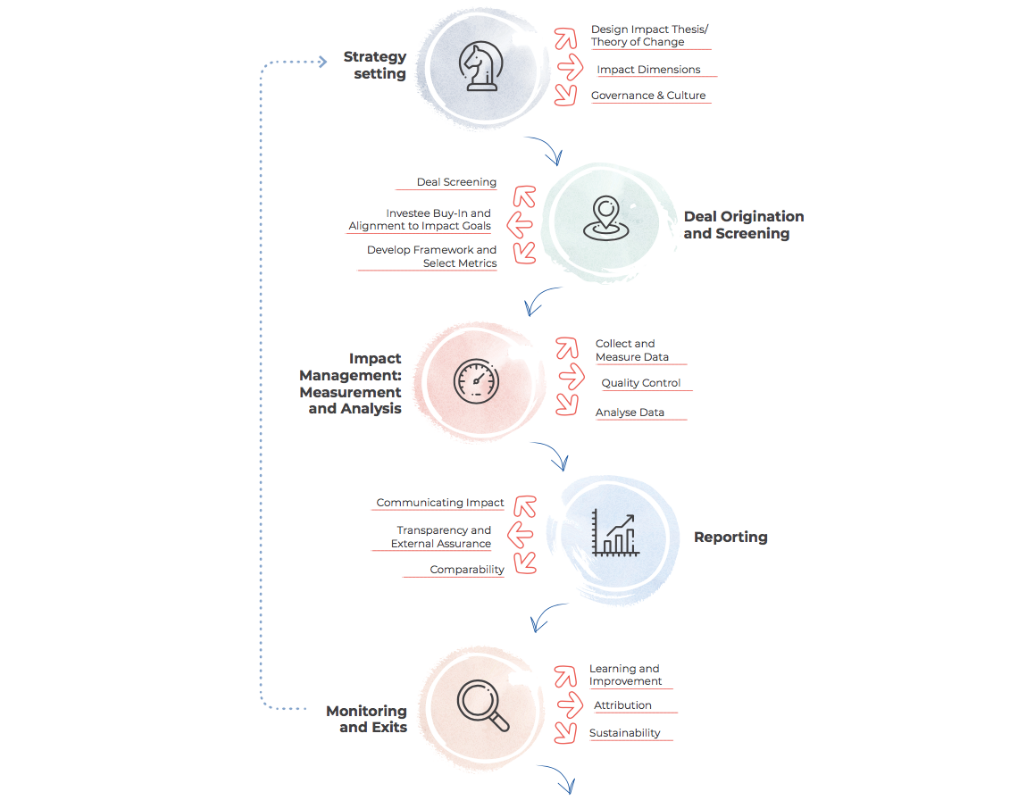

Simply put, IMM is defined as the process of measuring, assessing, and improving the impact of an investor’s portfolio on people and the planet. It enables investors to assess the nature and extent of the investee’s impact at each stage of the investment life cycle, and then apply the learnings to define and refine their investment strategy.

Impact is becoming an important aspect of evaluating the overall performance of an investment.

As we look ahead to a post-COVID-19 world, impact is becoming an important aspect of evaluating the overall performance of an investment. This trend towards focusing on impact is visible through a number of recent developments, such as outcome-based financing models (which includes social impact bonds and development impact bonds), and the setting up of an Indian social stock exchange.

Given this, the Impact Investors Council (IIC) collaborated with KPMG to publish a report which captures the current state of IMM practices among impact investors in India. This was done by surveying 26 leading impact investors active in India, through a series of virtual interviews conducted between May and August 2020.

The report examines their IMM practices at two levels—the macro and the micro—and develops an IMM framework to identify impact across five stages of the investment life cycle. This framework can also serve as a reference for new investors looking to integrate IMM into their investment process.

Related article: This is the most opportune time for impact investing

Progress, challenges, and common practices at the macro-level

More awareness on IMM has helped produce more research, explore tools and frameworks, and attract more participation from skilled professionals. Additionally, technological advancements have improved the measurement process. This has given investors the confidence to report the impact being created.

Investors are also consistently seeking out sophisticated measurement tools and frameworks to counter impact washing ie, the practice of making impact-focused claims without truly demonstrating positive social or environmental impact.

The industry hasn’t pushed measurement to the backburner, despite cost constraints and limited availability of evidence.

The report noted that the industry hasn’t pushed measurement to the backburner, despite cost constraints and limited availability of evidence. In fact, investors have shifted from a search for ‘plain accountability’ to ‘impact contribution’, where they are now keen on assessing their ‘additionality’ ie, the added value they bring to investees and the impact they generate.

Investors continue to directly spend a minimum of five percent of their operating budgets on IMM. With scale, stage of investment, and maturity, we expect this spend to increase to 15-20 percent.

While the industry is now on the path to recognise and rectify various gaps that exist, there are some challenges which are more difficult to counter:

- Measuring negative externalities and qualitative impact is challenging because of the intangible nature of both. Investors often find it difficult to articulate and quantify the additionality they bring through their investments. We are however seeing that global frameworks and metrics defined by the Impact Management Project (IMP), Sustainable Development Goals (SDGs), and IRIS+ are gaining prominence even in India. Investors are using these to gradually address the challenges of standardisation and benchmarking.

- Another old problem with the impact sector in India has been the lack of any credible baseline data for impact measurement. Thus, there is no clear reference or starting point to compare the intervention’s outcome against, which makes it difficult to measure progress. The Government of India’s policy think tank, NITI Aayog has now begun to do some work in this area through their SDG Baseline Reports.

- When it comes to social entrepreneurs, we have seen that they often struggle with articulating their impact thesis and identifying impact-specific key performance indicators (KPIs) for their enterprise. Entrepreneurs often find measurement beyond the company’s business operating metrics challenging. We expect this to change as the industry and IMM evolve.

Another old problem with the impact sector in India has been the lack of any credible baseline data for impact measurement. | Picture courtesy: Rawpixel

Impact in the investment life cycle at the micro-level

To effectively measure and manage impact, it is important to have an IMM framework that runs across the life cycle of an investment fund (ie, from due diligence, to post-investment management, to exit and beyond). We evaluated our investors’ IMM practices across 15 areas, spanning five stages of the investment life cycle.

In the first stage of the framework, we tried to evaluate investors’ impact strategies and goal setting processes, as well as their organisations and employee culture toward impact.

Investors have also begun to focus on formal IMM-focused learning and development for their employees.

Almost all investors have a sound and well-rounded impact strategy at a portfolio-level. Impact is in the DNA of most of the organisations we interviewed and therefore there is a natural alignment between plans and tangible actions. A large percentage of investors have also begun to focus on formal IMM-focused learning and development for their employees. That said, more than 90 percent of investors interviewed do not have any monetary or other employee incentives tied to their impact goals.

Related article: Impact is the new mainstream

Here, we tried to understand how investors screen potential investment deals, conduct impact due diligence, and get investee buy-in. The study found that a vast majority of impact investors conduct a structured impact due diligence to assess the impact orientation of the company. While the investment teams are trained to understand impact parameters and filters, the level of sophistication of this due diligence process varied with the size and maturity of the investor organisation.

We also observed that almost all investors tend to work with the investee organisation to formulate impact goals and strategies. About 50 percent of investors also incentivise (monetarily or otherwise) investee enterprises to achieve impact goals through follow-on capital, provision of philanthropic capital, and so on.

Investors we spoke to collected, measured, and analysed impact data of investee companies on a quarterly basis, which is a global best practice.

Most used the company’s existing financial and operating metrics to evaluate impact performance to avoid duplication of efforts. Multiple investors have, however, begun to leverage tech-enabled tools such as 60 Decibels’ Lean Data or other proprietary tools to track, measure, and analyse impact-specific metrics. Technology has considerably brought down the cost of data collection and impact measurement and we expect more progress on this front going forward.

Many investors also have an impact oversight committee or an independent impact team to oversee the IMM process, to ensure quality. However, we are yet to see the benefits of this oversight process and its direct correlation to the quality of impact management.

IMM framework across the investment life cycle | Source: State of Impact Measurement and Management in India

There is a growing trend of funds pushing for transparency, as they publish standalone impact reports mapped to the SDGs. However, they can improve the quality of reporting by capturing impact outcomes, beyond immediate outputs such as number of people reached and value of goods sold.

A large proportion of investors do not conduct an independent formal audit on investees’ impact reporting and rely primarily on self-reported data by the investee. Given the additional costs attached with audits we may not see substantial change on this front in India.

Comparing and benchmarking impact returns has its own set of challenges.

The comparing and benchmarking of impact performance can be a key driver in growing the impact investing industry. However, unlike financial returns, comparing and benchmarking impact returns has its own set of challenges, given the diversity in sectors, geographies, business models, and even stage of operation of impact enterprises. Thus, investors currently consider comparability a ‘good to have’, but not a ‘must-have’.

Related article: The rise of gender lens investing in Asia

In this last stage, we focused on understanding the specific practices and feedback loops that investors use to monitor impact, and the key considerations for sustaining this impact post-exit.

A majority of investors review and monitor their impact operation plans annually. They then use their learnings to help improve the investee company’s products and services. While exit constraints exist for the industry, investors saw the ‘selection of a mission-aligned buyer’ as a key strategy for exiting responsibly. All funds believed that the single most critical aspect to safeguard against mission drift is to identify an investor who is strategically aligned to the investee’s business model or shares their impact motivations.

We also tried to understand how investors try to address the problem of ‘attribution’ or ‘over reporting’ of impact. At the moment though, the industry is still at a nascent stage to completely solve for this issue. For now, investors are focused on maximising the contribution of their investments.

Almost all impact investors are beginning to understand the significance of IMM.

During the course of our research, we found that almost all impact investors are beginning to understand the significance of IMM. Multiple investors who had been adopting an ad-hoc approach to manage impact are now shifting to a more formalised and rigorous approach.

While pressure from external stakeholders could be partially responsible for the shift towards rigour and discipline, it is definitely a sign of evolution and maturity in the industry. The industry now needs to change its perception that IMM is burdensome and costly. Investing time and resources in IMM will enable portfolio companies to scale and generate greater financial, social, and environmental returns.

—

Know more

- Explore this guide to getting started with impact measurement and management.

- Watch this panel discussion on the state of impact management in India.