The legal framework governing civil society in India is rapidly evolving, and there is a labyrinth of regulations affecting the governance, funding, and taxation of nonprofits in India. The International Center for Not-for-Profit Law’s India Philanthropy Law Report 2019 unpacks these laws, highlighting recent legal developments and analysing their implications for the functioning of Indian nonprofits. Here are 10 highlights from the report:

Nonprofits may be registered as public charitable trusts, societies, or Section 8 companies. It is estimated that there are currently 3.3 million nonprofits in India, though this includes a number of them which may no longer be active. Each of the three forms are governed by different regulations. Both charitable trusts and societies are generally subject to state laws which vary across states, while Section 8 companies (public and private) fall under the ambit of the central Indian Companies Act, 2013.

Nonprofits in India may also choose to operate as an informal organisation, but in doing so, they cannot obtain tax exemptions for themselves or tax deductions for their donors.

In addition to this, the Income Tax Department may require anywhere between three to six months to grant tax exemption status (Section 12AA of the Income Tax Act, 1961) and to process donors’ tax deductions (Section 80G). The processing of applications for a nonprofit to receive foreign funds under the Foreign Contribution (Regulation) Act (FCRA), 2010, can take another three to six months.

However, trusts, societies, or Section 8 companies working in the area of education and health may complete the registration process more quickly (as compared to an advocacy organisation or one seen to be conducting commercial activities).

Related article: IDR Explains: FCRA

Nonprofits in India are prohibited from engaging in a wide range of political activities, including political campaigning and direct political advocacy. They can, however, communicate with legislators, government officials, or the media to indirectly influence political processes.

Nonprofits in India are prohibited from engaging in a wide range of political activities.

Though the definition of what makes a nonprofit’s activities ‘political’ is ambiguous, the courts in India have ruled that an organisation whose primary goal is political in nature cannot have been established for charitable purposes.

There are no restrictions on the incidental economic activities of trusts, societies, or Section 8 companies. A nonprofit must maintain separate books of account for the commercial activities, and any profits received must be applied fully towards towards the primary charitable purpose of the nonprofit. However, if a nonprofit generates business income in excess of 20 percent of its total income from donations and grants, it may lose its tax exemption status and be taxed at the maximum marginal tax rate of 30 percent.

The Companies Act, 2013 mandates that companies with a net worth of INR 5 billion or an annual turnover of INR 10 billion are required to spend a minimum of two percent of their average pre-tax profit each fiscal year on CSR activities. If they were unable to comply, the company simply had to provide an explanation in its annual report, without any legal requirement to spend the remaining money.

However, under Article 21 of the Companies (Amendment) Act, 2019, a company that fails to spend the full amount can deposit the remaining funds in escrow with a bank included under the Second Schedule of the Reserve Bank of India Act, 1934, and spend those funds on CSR-related activities within three years. If it still fails to spend the money within three years, or does not have any ongoing projects, it must transfer the unspent amount to a fund specified in Schedule VII of the Companies Act, 2013. This includes the Prime Minister’s National Relief Fund or funds set up by the government for the socio-economic development, relief, and welfare of marginalised groups.

As of January 2020, this provision has not come into force.

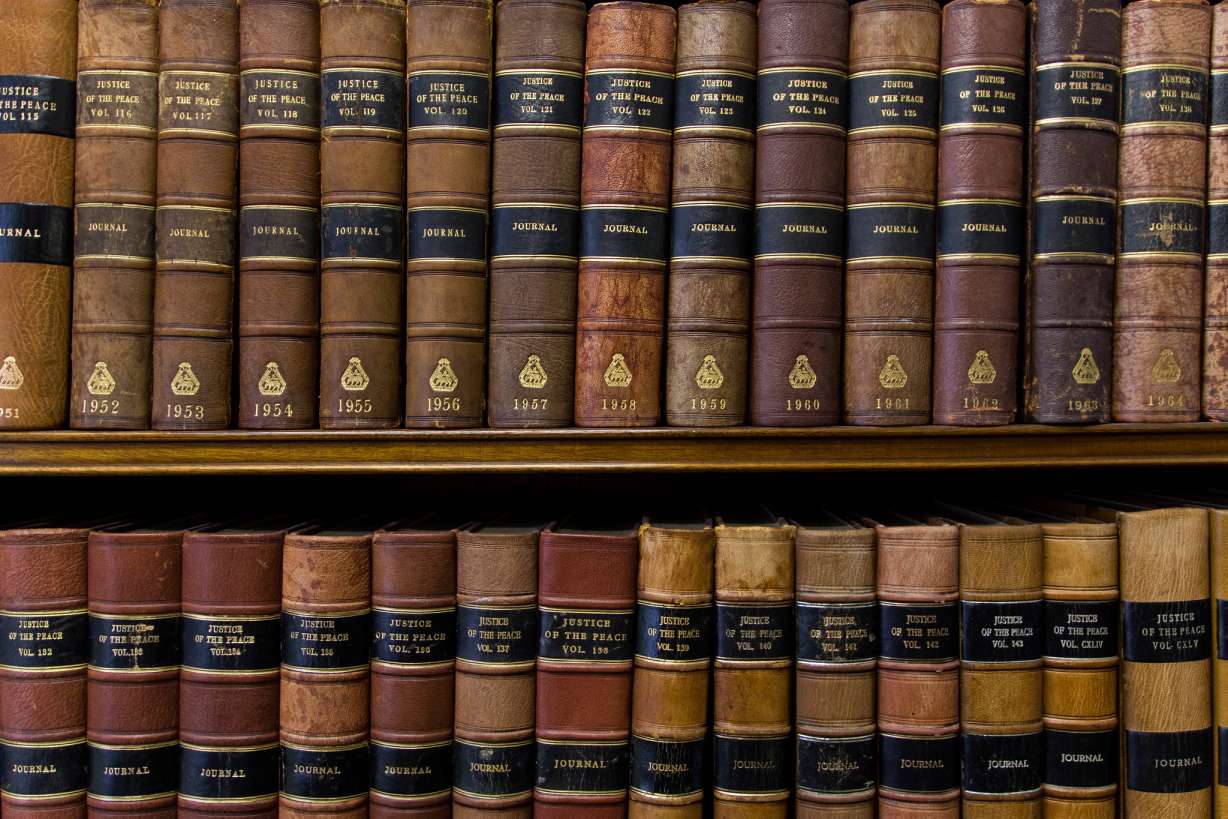

The legal framework governing civil society in India is rapidly evolving. | Photo courtesy: Flickr

Section 12AA of the Income Tax Act, 1961, which grants tax exemptions to nonprofits, was amended under the Finance (No. 2) Act, 2019. This amendment allows the Principal Commissioner or Commissioner of Income Tax to cancel the registration of a charitable trust or institution that has engaged in activities, programmes, or projects that are not listed in its trust deed, or memorandum and articles of association.

This deregistration will affect the organisation’s tax benefits. The organisation will be required to pay annual income tax at a rate of 30 percent, as well as an annual tax on accreted income, i.e. the amount by which the aggregate fair market value of total assets exceeds the total tax liability of the association. The latter rule is extremely important for organisations with immovable property.

A society or Section 8 company may be voluntarily dissolved if the objectives for which it was registered are achieved or are no longer relevant, or if the governing body is no longer interested in continuing the organisation.

The government can also decide to unilaterally dissolve a society or Section 8 company if it deems the organisation’s activities “against national interests or the sovereignty or integrity of India.”

Section 44 of the Lokpal and Lokayuktas Act, 2013 requires public servants to declare their assets to the Ministry of Home Affairs. Trustees and officers of charitable organisations will be considered ‘public servants’ if their organisations receive government grants of over INR 10 million or foreign funds over INR 1 million, within a fiscal year.

The specific rules under this Act are still being finalised.

Indian nonprofits face restrictions not only around where and how they operate, but also around the acceptance of foreign funding.

For instance, foreign money collected by an Indian citizen on behalf of an Indian nonprofit would be considered a foreign contribution under the FCRA. Similarly, funds raised in India, in Indian currency, are seen as foreign contributions if they are from a non-Indian citizen. Conversely, money from expatriate Indians are not viewed as foreign contributions, until and unless the person has become a citizen of a foreign country.

Related article: CSR giving in India is heavily skewed

The Ministry of Home Affairs has published guidelines on compliance with the FCRA, which warns against the use of cash payments and debit-card withdrawals of over INR 2,000 by nonprofit with FCRA accounts. Though debit cards are usually not issued for foreign contribution accounts, organisations with such cards should not use it for cash withdrawals or online payments.

This warning is likely to have the greatest implication for civil society organisations working in remote, rural areas that tend to operate on a cash economy.

Additionally, nonprofits receiving foreign contributions are prevented from using more than 50 percent of these funds for administrative expenditures. These administrative expenditures include remuneration for board members and trustees, office expenses, accounting costs, etc. Expenses related to the core activities of the organisation, such as salaries for researchers, trainers, hospital doctors, or school teachers, are not considered administrative, and are exempt from this restriction.

A violation of these conditions is considered a compoundable offence, which means that it can be settled by the involved parties through compromise, after the payment of a fee. For almost every offence, the FCRA imposes a minimum penalty of INR 100,000.

In general, donors are permitted to deduct contributions to trusts, societies, and section 8 companies that have been granted charitable status. However, for donations to institutions specifically listed under Section 80G of the Income Tax Act, donors are entitled to a 100 percent deduction. This list includes a number of government-related funds such as the Prime Minister’s National Relief Fund and the National Foundation for Communal Harmony, among others.

To qualify for a tax deduction, any donation above INR 10,000 must not be made in cash.

Donors must keep in mind that total deductions must not exceed their total gross income by more than 10 percent, and that in order to qualify for a tax deduction, any donation above INR 10,000 must not be made in cash.

Domestic nonprofit organisations without an FCRA registration may receive foreign money for commercial services provided, and are not required to report this to the FCRA department.

Disclaimer: The information given here is a reflection of the report’s authors’ understanding of laws and regulations currently in effect in India, and does not constitute legal opinion or advice.

An earlier version of this article stated that the Companies Act, 2013 mandates that companies with a net worth of INR 500 billion are required to spend a minimum of two percent of their average pre-tax profit each fiscal year on CSR activities. It was corrected on February 24, 2020 to INR 5 billion.

—

Know more

- Learn more about why the nonprofit sector in India needs comprehensive legal reforms.

- Explore the Center for the Advancement of Philanthropy’s blog, which features the latest legal and compliance-related developments in India.

- Read an analysis of publicly available data and trends around the FCRA.

Do more

- Need legal and compliance advice? Reach out to Centre for Advancement of Philanthropy (CAP) at connect@capindia.in.

- Sign up for a WhatsApp group created by the CAP for updates and/or discussions on the issue of nonprofit regulation and compliance. To be added to the group, email cap.csip@ashoka.edu.in with your name, organisation name, WhatsApp number, and location.