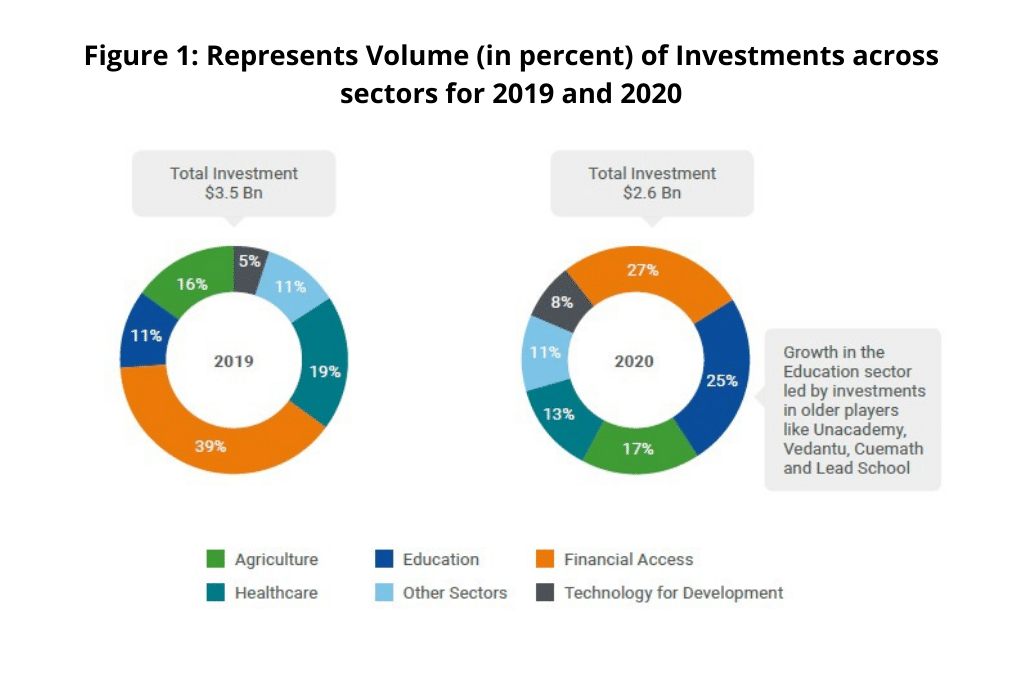

Despite the global health pandemic and its accompanying effects on the business and economic environment in 2020, impact enterprises received USD 2.6 billion in investments across 243 equity deals and saw 13 successful exits.

And while overall investments fell by 25 percent vis-à-vis 2019, impact investors continued to pledge their support to solving critical social and environmental challenges through investments in scalable, tech-based, innovative social enterprises.

According to the annual impact investment research report, ‘2020 in Retrospect: India Impact Investment Trends’, the Indian impact sector will be more tech-led in the future. The COVID-19 pandemic has been a game-changer for the sector, with the lockdown and physical distancing norms rapidly increasing the adoption of internet and digital devices across all classes of society.

Seed-stage tech investments drove most of the growth in 2020

While overall impact investments in 2020 fell 25 percent as compared to 2019, the sector witnessed a 16 percent rise in seed stage investment volume. Investors were most keen to back early-stage tech enterprises in the agriculture, livelihoods, and healthcare sectors. The decline in overall impact investment in fact was led by the fall in late-stage investments in financial access and healthcare enterprises.

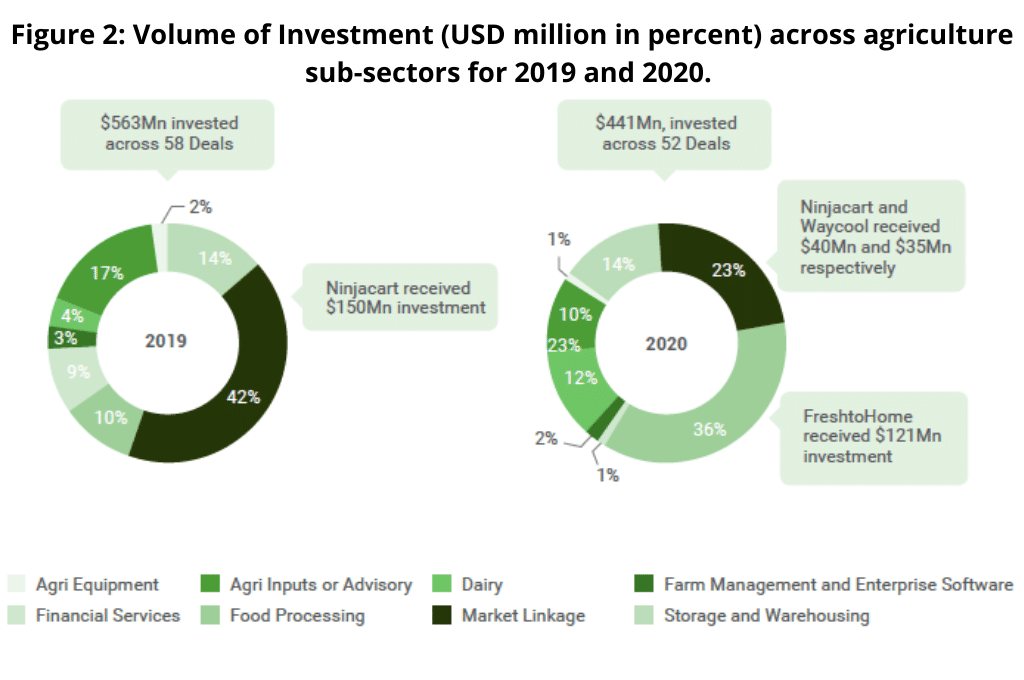

Agriculture stayed the course during the year

The pandemic and strict lockdowns caused widespread disruptions across the agriculture supply chain, including the closing of markets, breakdown of procurement, and a halt in several on-ground operations. Despite this, enterprises in the agriculture sector attracted approximately USD 440 million across 52 deals in 2020. The sector continued to see active investor interest, and the number of deals in 2020 remained almost unchanged from 2019. Industry experts expect a steady inflow of investments in agriculture to continue throughout 2021.

The past few years have seen multiple agri-tech start-ups emerge in the agri inputs advisory, and market linkage sub-segments space. It is therefore not surprising that 70 percent of the deals in the sector have been with seed- and Series A- stage enterprises both in 2019 and 2020.

The expectation is that enterprises focused on enhancing market linkages in the agricultural value chain will continue to see investor interest. This is because farmers are increasingly relying on technology to ease supply chain bottlenecks, eliminate middlemen, improve transparency, and ensure they earn a bigger chunk of sale proceeds. Agri-inputs startups in pre-harvesting will also see greater investor attention as farmers adopt innovative solutions for productivity improvements.

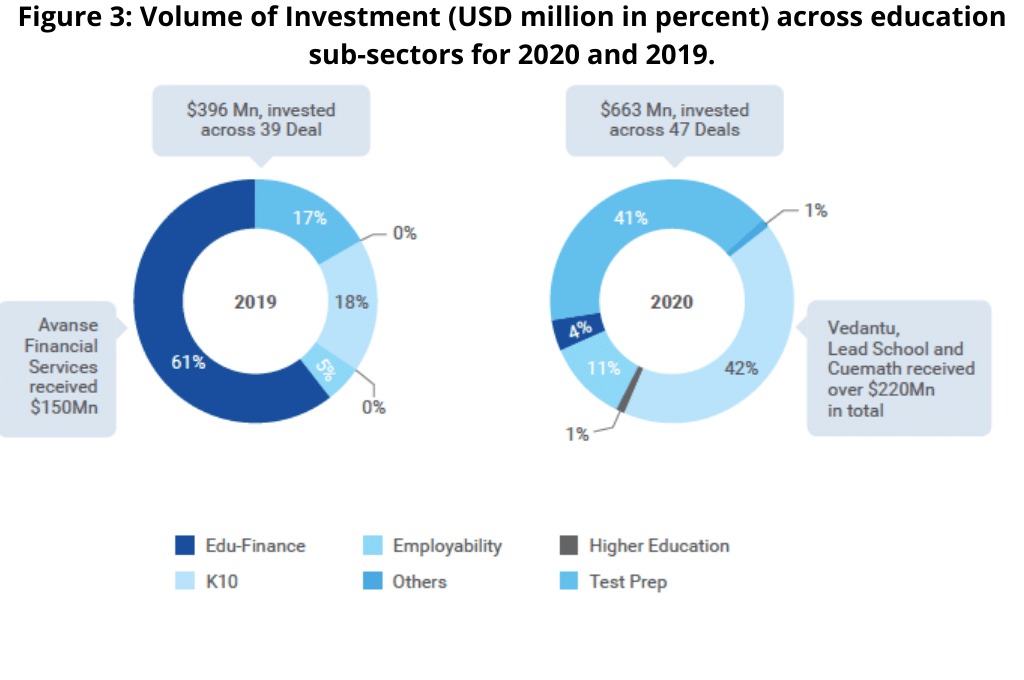

Education witnessed a record level of investment

With the national lockdown impacting traditional modes of education, there was a dire and urgent need for remote tech-based solutions to ensure that 335 million students enrolled in schools across the country could continue to learn.

As investors realised the opportunity that the crisis provided to EdTech companies, investment volumes in education rose by 65 percent to USD 660 million, while the number of deals increased to 47, a jump of 20 percent from the 2019 levels. Most of this was due to a rise in Series B and later-stage deals which saw a surge of 70 percent in investment volumes and 50 percent increase in the number of deals.

The COVID-19 pandemic led to a total shut down of all schools for a significant part of the year, resulting in poor cashflows. As a result, the education finance sector seemed less attractive to investors and experienced an 85 percent fall in investment volumes vis-à-vis 2019.

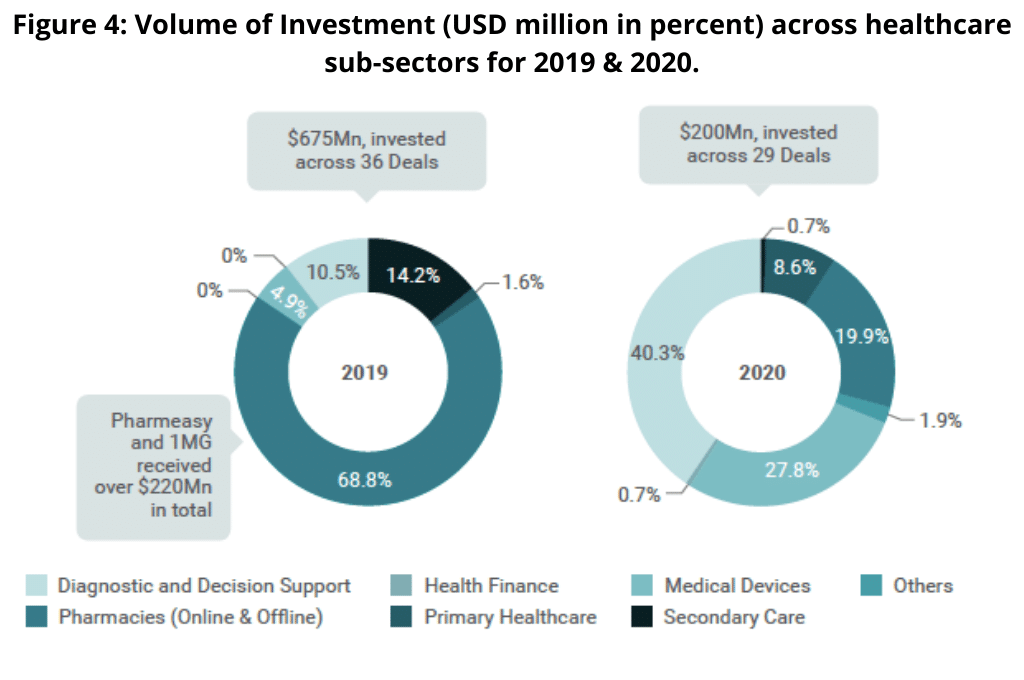

Healthcare sector showed promise only in seed-stage investments

Despite the enhanced focus on health-related agendas during the pandemic, healthcare impact enterprises attracted the least volume of investments in 2020 totalling USD 200 million across 29 deals. This was a stark fall of 70 percent in investment volume, and 20 percent in the number of deals vis-à-vis 2019.

The fall also appears to be substantial because multiple large ticket deals took place in the late-stage online pharmacy segment the year before in 2019.

In spite of the overall fall in investments, there was an approximately 85 percent rise in the number of seed-stage deals across healthcare segments in 2020. The pandemic, subsequent lockdowns, and the perceived risks of physically visiting healthcare clinics or hospitals led to telemedicine and cloud-enabled diagnostic tests gaining prominence in 2020. This was evident with investors putting their money in early-stage healthcare enterprises focused on telemedicine, AI-based solutions, and cloud-enabled diagnostic tests. Diagnostics and decisions support, medical devices and primary healthcare segments also saw a collective 30 percent rise in investment volumes.

Tech-enhancement in the sector will prove to be a critical enabler to provide last mile health care access to the masses. We can expect a renewed investor interest in enterprises providing affordable health-tech solutions, in 2021.

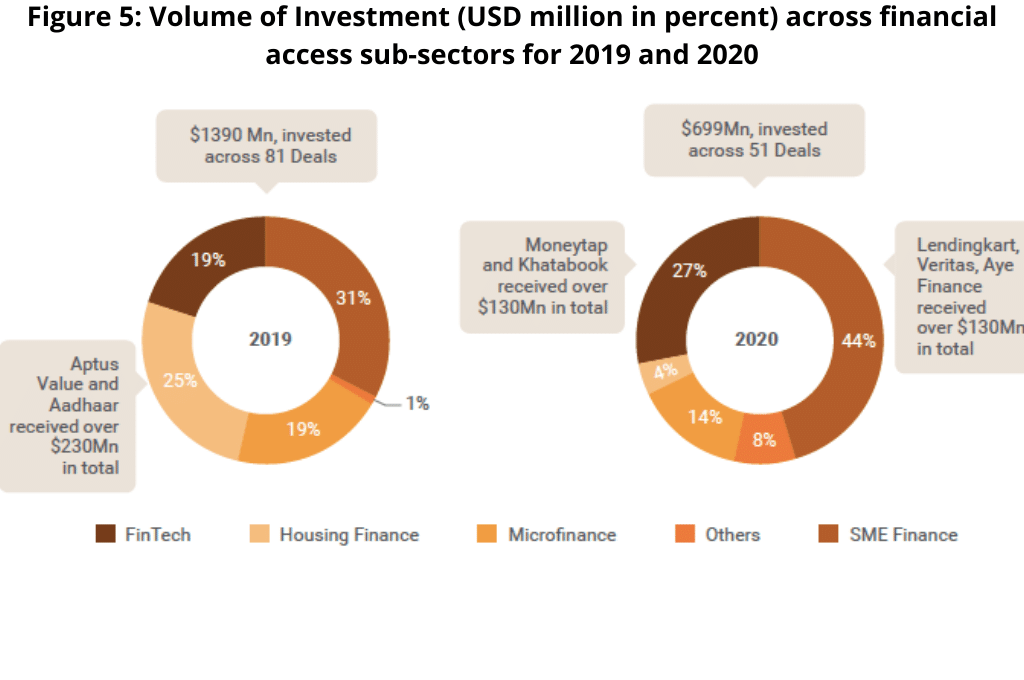

Absence of late-stage follow-on deals led to a significant decline in financial access investments

While the financial access sector received the maximum volume of investments in 2020—as it does every year—the pandemic adversely impacted its core market segments, namely late-stage enterprises across microfinance, housing finance, and commercial vehicle finance.

This resulted in a 50 percent fall in investment volume and 35 percent decrease in the number of deals vis-à-vis 2019.

In contrast to the more established financial access sub-segments, fintech did well in 2020. This was primarily because digital payments and transactions recorded remarkable growth given the strict norms around physical distancing. The country quickly turned to tech-based financial products for day-to-day transactions.

Financial access models such as insure-tech, banking, and savings tech, that go beyond just lending emerged as key impact solutions for the Indian market in 2020. Overall, this sub-segment saw enhanced interest with investments both in early-stage as well as late-stage enterprises like Khatabook, MoneyTap, and Setu. We expect to see this trend to continue into 2021.

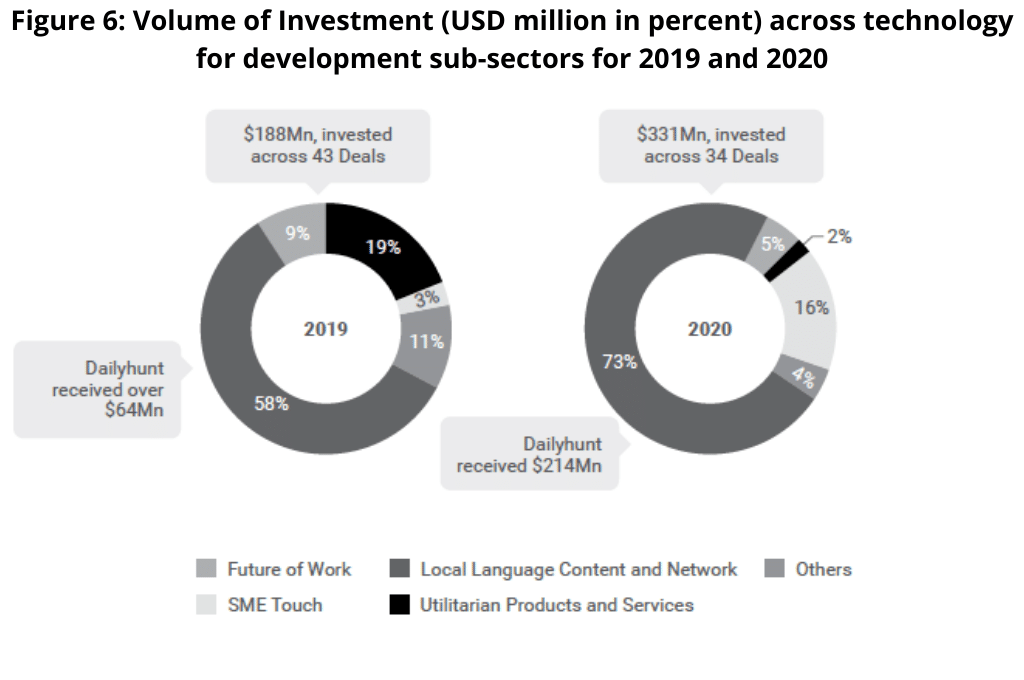

Technology for Development showed promise, especially in the Small and medium enterprises (SME) space

This segment essentially covers cross-cutting use cases of technology for social impact by providing (i) access to new markets and new products (Utilitarian Products), (ii) access to new sources of income (Future of Work), (iii) access to connectivity (eg SME tech) and/or (iv) access to content (media or vernacular). This does not cover the tech-enabled solutions covered in the other sectors.

As mentioned earlier, technology adoption leapfrogged years in 2020. This has opened up exciting opportunities for impact start-ups focussed on SME Tech, utilitarian services, and local language content.

The sector attracted USD 331 million, up 76 percent over 2019 levels. However, a large part of this was on account of a single enterprise, Daily Hunt, which alone received USD 214 million in 2020. The overall number of deals fell from 43 in 2019 to 34 in 2020.

Opportunities in digitisation for SMEs was a substantial focus area for investors in 2020. Early-stage, innovative, tech-based enterprises catering to the SME sector, observed a 7-time increase in investment volume in 2020 totalling USD 51 million in 2020 versus USD 6 million in 2019.

Notwithstanding the pandemic, Indian impact enterprises have proved to be resilient: Entrepreneurs were quick to pivot and re-orient businesses to meet the needs of the people. Tech-enabled impact enterprises gained traction and attracted significant investor interest, especially in the education sector. While there was a fall in investment volumes in 2020, we expect investment levels to normalise in 2021.

—

Know more

- Read this article to understand the evolving landscape of impact investment in India.

- Learn more about the future of impact investment in India.

- Read what India’s leading impact investors have identified as catalytic investment opportunities that can help create outsized impact.

Do more

- Connect with the authors, Ramraj Pai, Shriya Nene, and Swasti Saraogi, if you’d like to learn more about IIC’s work on impact investing in India.