The government is set to present the budget to the Parliament in just a few days. This will be the last budget before the general elections due in May this year and like many, I am curious to see what is coming up. While the print and TV media is fixated on debates centred around the pre-election survey, I have been busy studying the Startup India policy to see how the budget may have implications on it.

The government launched the Startup India initiative in 2016, and in a mere span of two years, our country has witnessed the build-up of a strong ecosystem fostering innovation and entrepreneurship. While FY 2018-19 was fundamental in unearthing, hand-holding, mentoring and nurturing many startups, there was potential for a lot more. Thus, it is the clauses of the existing policy that I would like to re-look at, for steeper scale and larger impact.

So, I will first talk about my take on the existing Startup India policy, and then highlight some recommendations for the upcoming budget. The aim of this is to build a conversation around the central budget and its impact on the social entrepreneurship sector.

Using the ‘Fund of Funds’ more effectively

The Fund of Funds introduced by the Modi government in 2016 was an important step towards making startups a viable means of livelihood for entrepreneurs. Fund of Funds for Start-ups (FFS) contributes to various Alternative Investment Funds (AIFs) with a corpus of INR 10,000 crore. Introduced with a focussed objective of supporting development and growth of innovation driven enterprises, the FFS facilitates funding needs for start ups through participation in capital of SEBI registered Venture Funds.

The aim is to build a conversation around the budget and its impact on the social entrepreneurship sector.

However, a substantial percentage of the INR 10,000 crore fund is yet to be utilised effectively. I honestly believe that this can be made relevant to funding startups, if the fund of funds targets seed stage funds. High performing incubators should be encouraged by the government to set up seed stage funds and the FFS should invest in them. Having an intermediary to facilitate this will make this happen. For instance, an incubator like Villgro or CIIE which has set up funds (Menterra by Villgro, Bharat fund by CIIE) will be in a position to do this.

Related article: The startup playbook

Another way to enhance the effectiveness of FFS would be to de-risk angel networks and their members. The FFS can serve as a first loss guarantee for angel investments made through angel networks with the possibility of the FFS covering the loss incurred by these investors. This possibly would also trigger a larger number of such networks in tier 2-3 cities across India. Startup India along with Indian Angel Network, Native Angel Network, and others can create this infrastructure with FFS de-risking them.

Finally, there should be a defined proportion of the INR 10,000 crore FFS that is earmarked just for social impact funds. This will allow larger social issues to be addressed through innovation and enterprise.

Improving access to the Credit Guarantee Fund (CGF)

The Credit Guarantee Fund (CGF) is another great initiative focused on small startups. The CGF has a corpus contribution of INR 2,000 crores that can enable startups to raise loans without any collateral for their business purposes. However, it is still extremely difficult to access this fund since most banks continue to be risk averse. That is why the government should encourage banks to work with incubators and leverage seed funds, such as from Department of Science and Technology (DST) and Biotechnology Industry Research Assistance Council (BIRAC) as first loss guarantee in addition to the CGF. This will truly allow the CGF to support start ups.

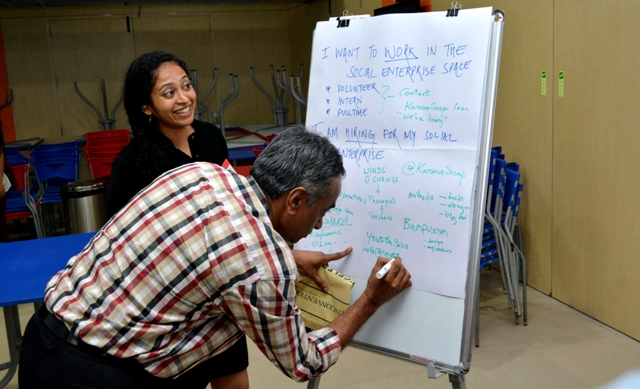

Leveraging existing industry thought leaders and events

In a country as huge as India, the government cannot shoulder the burden of social issues all on its own. It should tie up with social enterprise supporting organisations like Villgro and partner in events that inspire social entrepreneurs. If the government can find a way to leverage such events, it can make the whole process of identifying talent and aiding them with reforms, much easier.

Related article: India’s impact capital vacuum–and what to do about it

Suggestions and recommendations for the upcoming budget

Fellowships are a great first step to encourage talented individuals who already have a leaning towards social impact. For example, the Prime Minister’s Rural Development Fellows and Teach For India Fellows spend two years deeply immersed in understanding the foundational problems of the country and the public education system respectively. This experience can encourage the fellows to become entrepreneurs after they graduate, enabling them to translate their experience into impactful and innovative ideas that are grounded in reality. Every graduating doctor, for instance, has to spend one year in a village health center. Is it possible to make students enjoying government-subsidised fees at an IIT or NIT spend a few years with start ups in rural areas? Incubator and university networks should be leveraged to achieve this.

The government should identify and rope in senior fellows or entrepreneurs-in-residence to work with start ups. Kerala Startup Mission has a programme that pays senior talent to do this. This could be replicated in other start up hot pockets, thereby strengthening the social impact mentor ecosystem in the country. One thousand such fellows recruited and matched with start ups can be a great starting point.

The government should identify a ‘grand challenge’ for various social sector issues, and offer a significant prize to those who develop a solution for it. Such grand challenges will stimulate our scientific and engineering institutes and their high quality faculty to develop solutions for real world, base-of-the-pyramid problems. Various government departments have announced these, such as Agri Grand Challenge (for which Villgro is the incubation partner), Defence India Startup Challenge, and for petroleum; but we haven’t seen significant traction in other sectors like healthcare and education.

One of the bigger challenges that social start ups face today is accessing working capital while they are trying to scale up their business. Even when it is available, it is very expensive for them to access. This problem can be eliminated by updating External Commercial Borrowings (ECB) regulations. Like how microfinance institutions are currently allowed under the regulations to raise debt from abroad at lower cost, social enterprises should also be allowed to do so. I would even say that social enterprises could be classified as eligible for ‘Priority Sector Lending’ for at least a period of 10 years. This will enable banks to take the risk, become more friendly to the challenges of social start ups, and build financing that is start up-friendly.

Currently, registration under FCRA allows incubators to attract grants and donations from foreign sources for any charitable purpose. However, FCRA prevents them from using the funding for any speculative activity, and equity investing in an incubatee by an incubator is considered as a speculative activity. Like it or not, foreign funding is important to encourage the channelling of more capital to start ups. Therefore, the government should consider modifying the ‘speculative’ clause and allow incubators to invest in their incubatees using foreign funding.

Conclusively, it is a great time to be starting up! The Startup India wave, if fine-tuned for social businesses, has the potential to solve some of our most pressing societal problems through entrepreneurship, and change the face of India, for good.

This article was originally published on Villgro’s blog. You can read it here.