The ongoing crisis has served as a major disruption to the development ecosystem. Needs on the ground are rapidly shifting, as are the priorities for organisations, funders, the private sector, and the government. Navigating these times requires nonprofit organisations to be more agile than ever, and prioritise their organisational sustainability by simultaneously fortifying their weaknesses and seizing new opportunities.

Navigating these times requires nonprofit organisations to be more agile than ever.

As a first step, nonprofits need to mitigate immediate risks to operations and ensure people’s safety and well-being. Financial sustainability comes with that. Nonprofit leaders must be aware of ecosystem-wide changes to the funding landscape, which present both challenges and opportunities alike.

Related article: CSR is unlikely to fund new grantees this year

The CSR pie is shrinking

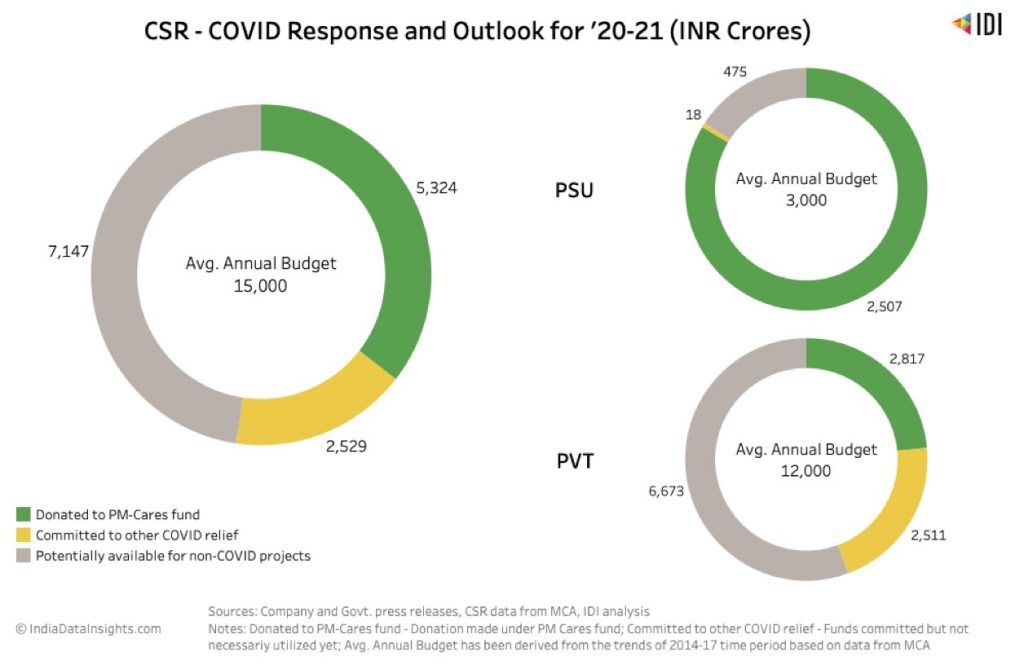

Between 2014-2018, approximately INR 50,000 crore was spent by CSR, of which INR 20,600 crore went to nonprofits. In FY 2020-2021, it is estimated that the CSR spend will be approximately INR 15,000 crore.1 Based on Sattva’s analysis of the top 300 companies and group CSR announcements, more than half the annual CSR budget—INR 7,800 crore—is already allocated to COVID-19 relief measures, including the PM-CARES Fund. Usually, about 50 percent of the CSR budget is deployed through nonprofits as implementation agencies, but this is expected to reduce by an additional 40-50 percent this year. CSR teams are unlikely to add new grantees unless for COVID-19-related activities, making this funding source an unreliable one in the upcoming financial year.

Source: Sattva

Ultra-high- and high-net-worth individual giving is rising and becoming more strategic

At a macro-level, ultra-high- and high-net-worth philanthropy has been rising steadily in recent years. In the coming decade, India is expected to have the highest wealth transfer among multi-generation philanthropic families—a figure estimated at around USD 128 billion. In addition, the list of Indian millionaires grows by 11 percent every year, largely driven by successful entrepreneurs, thereby potentially creating more philanthropists in the process. Inspired by a sense of action combined with deep networks, these decision-makers are expected to prioritise strategic giving for systemic change.

Foundations are looking to strengthen support to their bases

The challenge and uncertainty of these times is making foundations buttress support to their bases. Most domestic foundations are likely to repurpose their grants to meet the immediate and mid-term needs of their existing grantee partners. For international foundations, the reliability of India-focused work is likely to reduce as they might prioritise grants in home countries. That said, emerging ecosystem-wide collaborations could present new opportunities for nonprofits, across various sectors.

Retail giving is the short-term star

As per Sattva’s 2019 Everyday Giving research report, the estimated market size for retail giving was at INR 34,000 crore. These everyday givers are motivated by community, impact, urgency, and convenience. Online retail fundraising in crisis situations taps into all these four triggers. Online platforms such as Ketto have raised INR 30 crore over a 34 day period across various campaigns in 2020, and ChaloGive raised INR 8 crore through Indiaspora over a 25 day period as well this year.2 Prominent online crowdfunding platforms have waived off charges on funds raised during COVID-19 and it will be an essential avenue for nonprofits to tap into moving forward.

As a first step, nonprofits need to mitigate immediate risks to operations and ensure people’s safety and well-being. Financial sustainability comes with that. | Picture courtesy: Pexels

Given the trends in the funding landscape, there are five key measures nonprofit leaders can take to ensure financial sustainability in these troubled times.

In these troubled times, everyone is uniquely challenged; thus, reaching out to your networks and supporters can help in many ways. Reconfirming commitments with current donors to validate your inflows, engaging transparently, and cultivating funder relationships are important steps nonprofits can take. Nonprofit leaders should also leverage their board to make new connections, tap into quick wins through their CSR or ultra-high- and high-net-worth individual networks, and seek advice on financial management.

Nonprofits must also revisit their budget and costs within the current constraints. Each organisation will have a different operating model and cost structure, and should optimise accordingly. Understanding the key drivers of costs across overheads and programmes, optimising cash flows, and revisiting investments will be critical areas for review.

Related article: Nonprofit financial planning for COVID-19

This approach can help estimate the dependency on funding channels, potential for deficits, and possible burdens on corpus funds. Simple scenario planning templates can build in sensitivity analyses and allow leaders to understand the financial implications of both internal and external factors. It will be important for leaders to identify key risk drivers and develop best, worst, and probable case scenarios, with corresponding action plans for each one.

With its ease and focus during crises, retail funding can be a big boost for nonprofits. In normal circumstances, retail fundraising requires heavier upfront costs to build this engine of smaller donations from individuals. In times of crisis, however, it can be easier to leverage established platforms such as Ketto or Impact Guru for project based funding, or GiveIndia for specific target segments. While it is possible to get quick wins in, it will be important to take a long-term view and take a ‘walk-run-fly’ approach to stabilise, optimise, and scale retail fundraising.

Nonprofits can explore matching grants as a tool to tap into retail giving and augment their fundraising outcomes. In a matching contribution, a donor agrees to unlock a grant or a donation, once the nonprofit is able to raise an equal amount or more from other donors. The match-funder could be a corporate, family foundation, or an individual, and the organisation should prioritise conversations around matching grants, with long-standing donors. Organisations with limited experience in retail fundraising could partner with crowdfunding platforms that support in marketing and communication along with maximising outreach. A strong communication strategy which creates a sense of urgency, highlights the potential for impact, and emphasises the matching aspect, is key to success.

The current crisis will be an uphill battle for most leaders, but can present a wave of opportunities as well.

Navigating organisations through the current crisis will be an uphill battle for most leaders, but can present a wave of opportunities as well. By ensuring financial sustainability of the organisation, a major portion of institutional risks can be managed. By engaging with donors, optimising costs, conducting scenario planning, and crafting innovative retail campaigns, nonprofits will be a few steps closer to navigating the crisis more easily.

- Based on the average of the past three years’ earnings as per the Ministry of Corporate Affairs (MCA).

- Data calculated as on May 5th, procured from respective organisations’ websites.

At charcha 2020, Rathish Balakrishnan spoke about revisiting organisation strategy in light of COVID-19.

—

Know more

- Learn more about CSR’s COVID-19 response and outlook for FY 2020-2021 and what this means for nonprofits.

- Read more about the market of retail fundraising in India.

Do more

- To learn more about Sattva’s MAP framework (mitigating institutional risks, adapting programmes, and pivoting to emerging needs on the ground), reach out to covid19response@sattva.co.in.

- Nonprofits can use this toolkit to craft grant matching campaigns.

- Use this template to conduct a revenue scenario planning exercise for your nonprofit.