Poor menstrual hygiene causes 70 percent of the reproductive diseases among Indian women. Not surprising, considering more than 300 million menstruating women in India do not use any modern menstrual hygiene products. Or, they use unsanitary alternatives such as cloth, ashes, sand and husk.

Lack of access to menstrual hygiene products also disrupts schooling among adolescent girls, thus affecting their education outcomes. To a great extent, this problem is caused by lack of access to reliable sanitary pads.

In 2005, Arunachalam Muruganantham founded Jayashree Industries in Coimbatore, Tamil Nadu, with a pioneering idea for manufacturing low-cost sanitary pads. Using his machines, women in villages could make, sell and use quality sanitary pads in a cost-effective manner, dramatically improving menstrual hygiene in the rural areas. His own journey is a remarkable one and has been featured in news media outlets across the world.

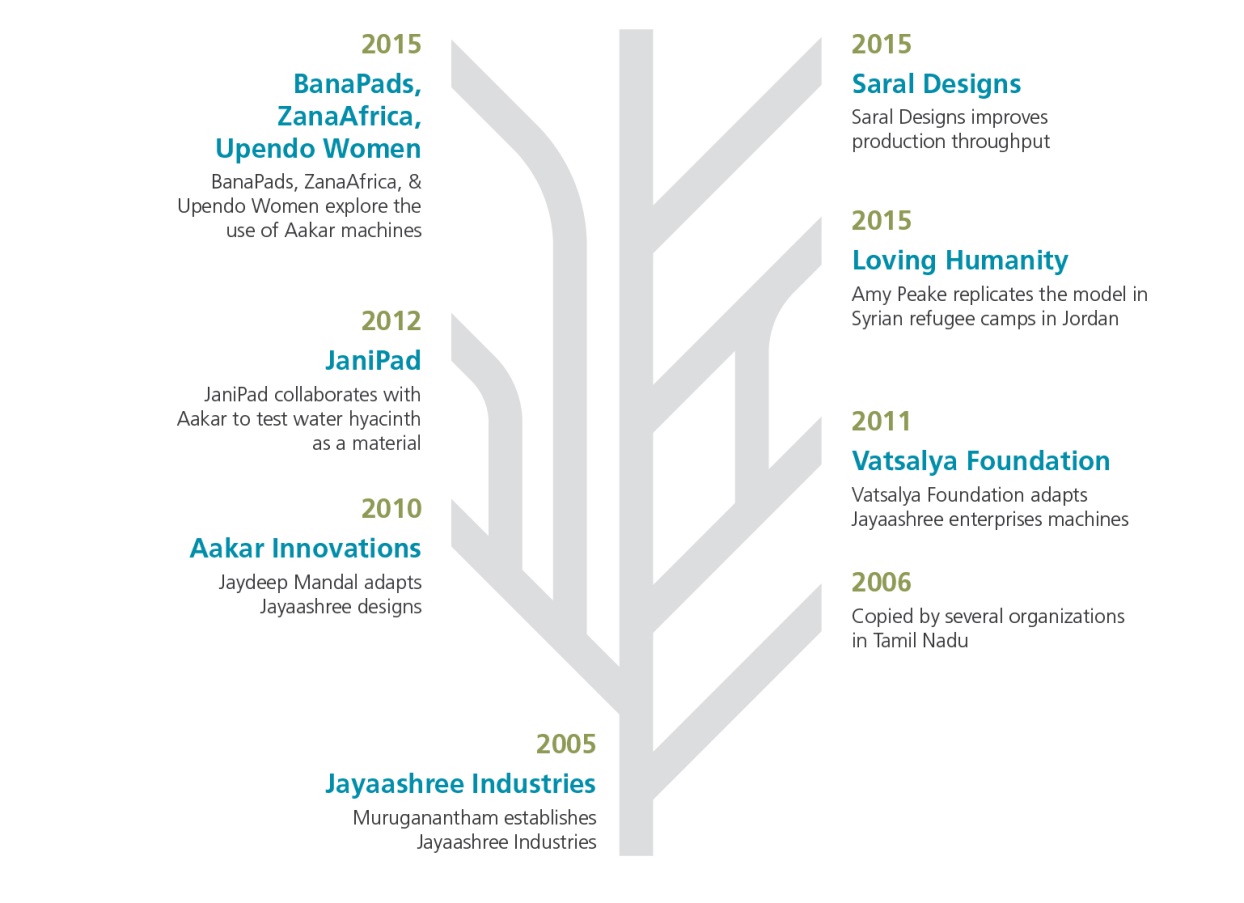

But what makes it even more interesting (and impactful) is that a diverse range of entrepreneurs have adopted his idea, spreading it across the rest of India, the Middle East and Africa (as illustrated below).

Example of scaling out–low-cost sanitary pad manufacturing

These ‘followers’ have adapted Muruganantham’s idea and applied it to their own contexts, making changes to product design, materials, machinery, even the business model itself. Some, like Jaydeep Mandal of Aakar Innovations, have been more intentional about building a scaling business than Muruganantham, and have brought more of the business skills needed for that.

Scaling Out

While ‘following’ or ‘replicating’ are convenient terms to describe these endeavours, they run the risk of considerably understating the degree of challenge involved: many of these entrepreneurs will still need boldness and ingenuity as they adapt, and often improve on, the original ideas that inspired them.

Scaling Out describes the process of taking ideas far beyond their original progenitors.

For this reason, we used the term ‘scaling out’ in a recent report to describe this process of taking ideas far beyond their original progenitors.

Why is this interesting? For us, it’s because we continue to be frustrated by the lack of large-scale, population-level benefits from impact enterprise and investing, a concern shared by many funders, intermediaries and investors.

Related article: Scaling: How to go from x to 10x

Scale = Pioneers + Followers

We believe that in order to really support scaling we must consider one question: Who comes after the first pioneers and what role do they play in taking promising models to scale?

Instead of creating entirely new models or solutions, these entrepreneurs build on existing breakthrough ideas that have yet to achieve their scale potential. They can often bring a stronger set of skills and experience than the original pioneers, and thus be more strongly positioned to build for scale.

They can also play a role in taking existing models to new customers and new geographies, particularly as the markets that serve the poor tend to retain stronger elements of local differentiation, compared with the increasingly interconnected markets serving richer communities around the world.

We do not have to look far to see how this has played out in the past. Consider the story of the microfinance institution (MFI) model here in south Asia. Many of the later MFI entrants in India were able to establish themselves much more quickly, with Equitas and Ujjivan taking just one and four years respectively to reach operating break-even, compared with Grameen Bank in Bangladesh which took 17 years.

While some of this reflects the benefits of learning gleaned from the pioneer’s experiences, it is also important to note that later entrepreneurs tended to have more of a commercial background and brought a stronger suite of business skills and experience to their efforts.

Scale = Matching Proven Ideas to Great Talent

Must we rely only on serendipity to make this work? The deep information asymmetries in this sector mean that great ideas and great talent do not naturally coincide to the extent that they do in the mainstream commercial world.

We believe that this not only results in too few businesses being started with strong ideas, but also keeps many talented individuals with valuable commercial experience outside the impact space because they feel compelled to come up with a good idea but are unable to.

Over the coming months, we will be exploring how we can build more effective vehicles to intentionally scale out ideas, solutions and business models that have already been tried and tested. We will be drawing on our own experience over the past decade, but also learning from others who have been doing this in India (such as Aravind and SELCO) and around the world.

This article is an abridged version of a longer article by Harvey Koh, “Scaling Out,” that first appeared in Stanford Social Innovation Review on February 23, 2017.

Material on the sanitary pad case study has been drawn from Koh, H., Hegde, N., and Das, C., (2016) Hardware Pioneers: Harnessing the Impact Potential of Technology Entrepreneurs, FSG.