Gender lens investing (GLI) is investing done with gender concerns as an important factor in the decision making process. It is done in order to get to better business, social, environmental, and investment outcomes; mitigate risk; and uncover new investment opportunities, among other reasons. GLI as a strategy is increasingly being leveraged by asset managers, large institutional investors, development agencies, family foundations, and retail investors.

While women’s participation in the workforce has steadily increased over the years, the presence of women in top executive and board position remains low, across sectors and geographies. This is especially true for the investment management industry, which, at four percent, might have one of the lowest shares of women in leadership positions.

GLI can therefore be leveraged as a tool to trigger a shift in the market dynamics on gender. Investors can direct capital to funds and companies that demonstrate a high level of commitment to gender equity, or that have gender-diverse leadership teams. They can also shift their internal processes, teams, and structures to become more gender-cognisant.

To better understand the GLI market as it currently stands, Sasakawa Peace Foundation, in collaboration with Sagana and Catalyst at Large, released the Gender Lens Investing Landscape report, to identify and deep dive into the gender lens investing vehicles, particularly in East and Southeast Asia.

Related article: Funds are recognising their biases against women

The basis of the private market data in the report, is the Project Sage 3.0 (2019) report by Wharton Social Impact Initiative and Catalyst at Large, and the basis of the public market data is the Public Market Scan (2019) by Veris Wealth Partners. Here are key highlights from the report.

There are several ways to conduct GLI

Motivations for investors to invest with a gender lens vary widely. These could include the realisation of the potential for better financial returns, or philanthropists seeking alignment between their investments and their philanthropic work, and so on. Each investor also defines and approaches GLI in a different way. Some of the approaches the report captures are:

- Providing women with access to capital, by investing in women as entrepreneurs, innovators, or leaders, and selecting businesses which are owned and/or led by women.

- Addressing workplace equity, by investing in businesses which aim to have a fair representation of women in staffing, management, boardroom representation, and along their supply chains, as well as have policies and practices promoting gender equality.

- Promoting products and services that disproportionately benefit women, by looking at women and girls as consumers, and investing in businesses that offer products or services that substantially improve the lives of women and girls.

- Incorporating the gender lens within their investment process, such as while sourcing, due diligence, defining metrics, and so on.

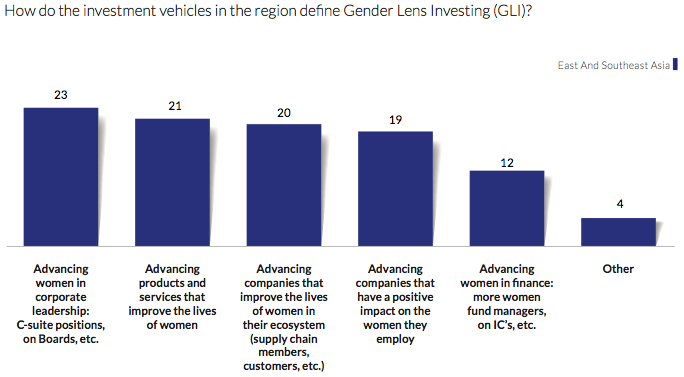

The definition of GLI varies

While there are many similarities, there are also a few differences. In Asia, all of the 23 investment vehicles agreed with advancing women in corporate leadership.

- More than 90 percent concur with promoting products and services which improve the lives of women.

- Eighty-seven percent acknowledge that they should be backing companies that improve the lives of women in their ecosystem.

- Eighty-three percent agree with advancing companies which have a positive impact on the women they employ.

- Fifty-two percent assent to advancing women in finance.

Source: Project Sage 3.0 survey

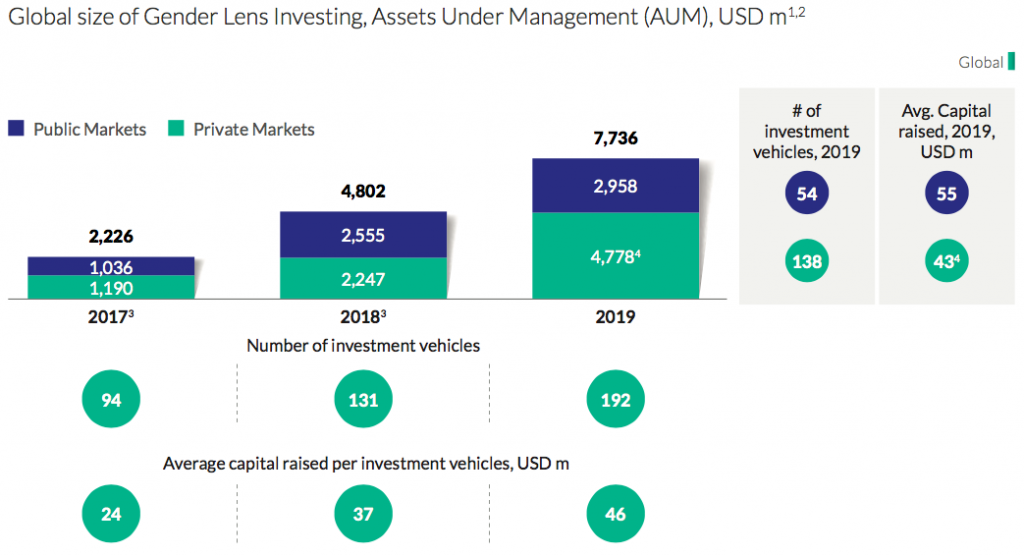

The GLI market is both big and diversified

This has increased by 61 percent from 2018. The number of investment vehicles has increased from 131 to 192. A majority of the shift is in private market vehicles, the overall size of which increased by more than double, as opposed to the public market, which has largely remained the same.

Source: Veris 2019 gender lens investing report, Project Sage 3.0 survey

The total capital raised by the 138 private market GLI vehicles in 2019 was around USD 4.8 billion; 3.3 billion of this capital was raised by investment vehicles that only invest in equity. Particularly in the East and Southeast Asia region, capital raised by GLI vehicles increased by 80 percent in 2019, again, largely driven by an increase in the number and size of private market investment vehicles.

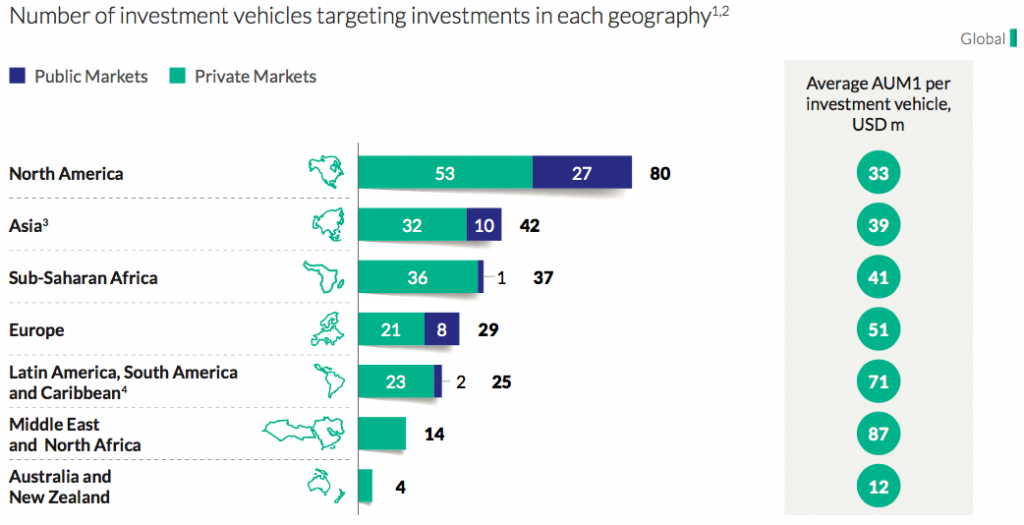

2. North America had the largest and Asia has the second-largest number of investment vehicles targeting them as an investment destination

In terms of assets under management (AUM), investment vehicles targeting North America represented 42 percent of all investment vehicles. Again, it is evident that the public market for GLI is quite underdeveloped, especially outside of North America, Asia, and Europe. In Asia, eight out of the 10 public market vehicles are based in Japan.

Source: Veris 2019 gender lens investing report, Project Sage 3.0 survey

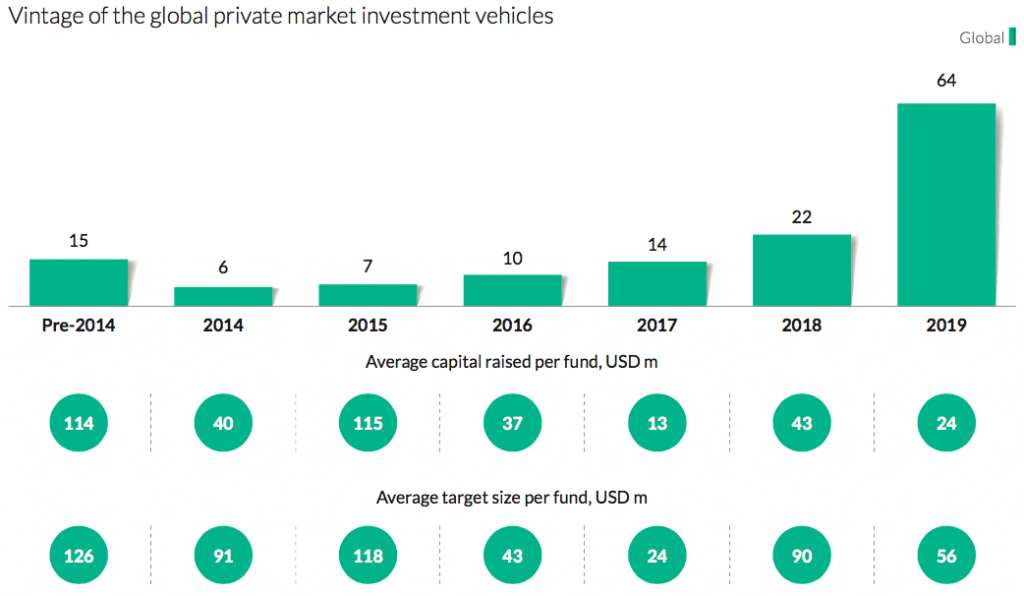

Given that the private market is bigger as well as more developed, the report shares some insights from this market. Here are significant highlights:

This was a jump of 190 percent from 2018—the highest increase so far. Given the increase in the overall number of vehicles, the average capital raised per fund decreased by almost 50 percent from 2018 to 2019.

Source: Project Sage 3.0 survey

The increasing interest of investors in GLI can be attributed to a variety of things: Asset managers realising the potential for better returns or decreased risk, philanthropic investors seeking better alignment between their investment and their philanthropic interests, among others.

Related article: Do our budgets pass the gender test?

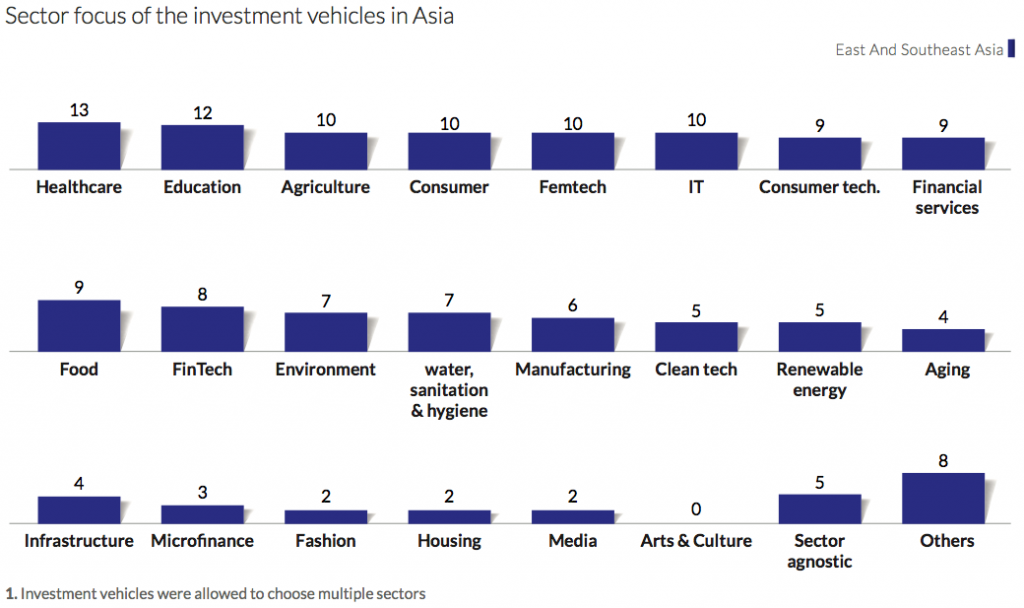

While healthcare, education, and agriculture are the top sectors that receive GLI capital, other sectors are not far behind.

Source: Project Sage 3.0 survey

The above numbers are available only for private market vehicles in the East and Southeast Asia region, and not globally.

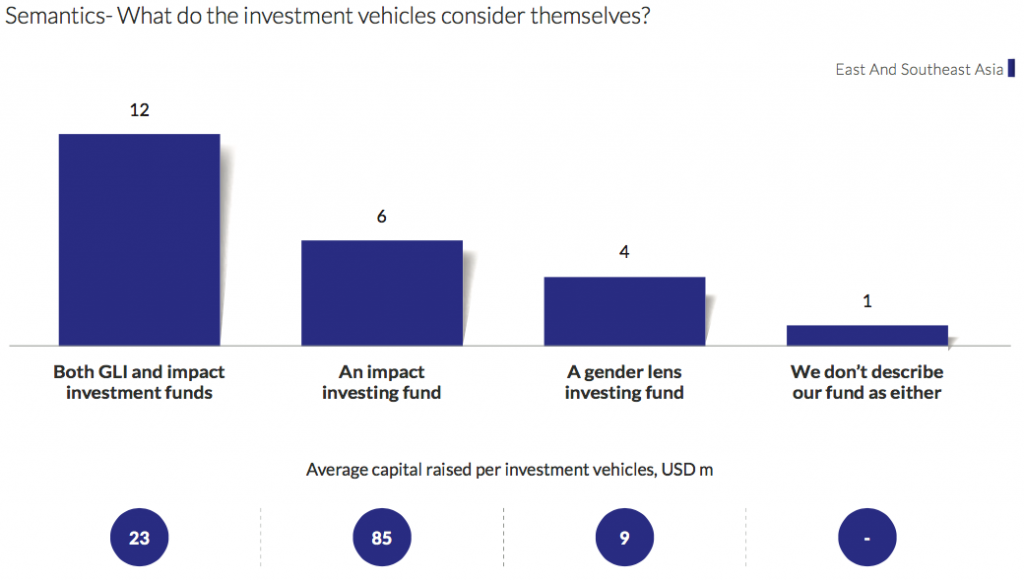

Around half of the investment vehicles consider themselves both an impact investing fund as well as a GLI fund.

Source: Project Sage 3.0 survey

The larger investment vehicles tend to consider themselves as impact investment funds, while smaller investment vehicles tend to consider themselves as GLI funds.

We have a long way to go with regard to gender diversity

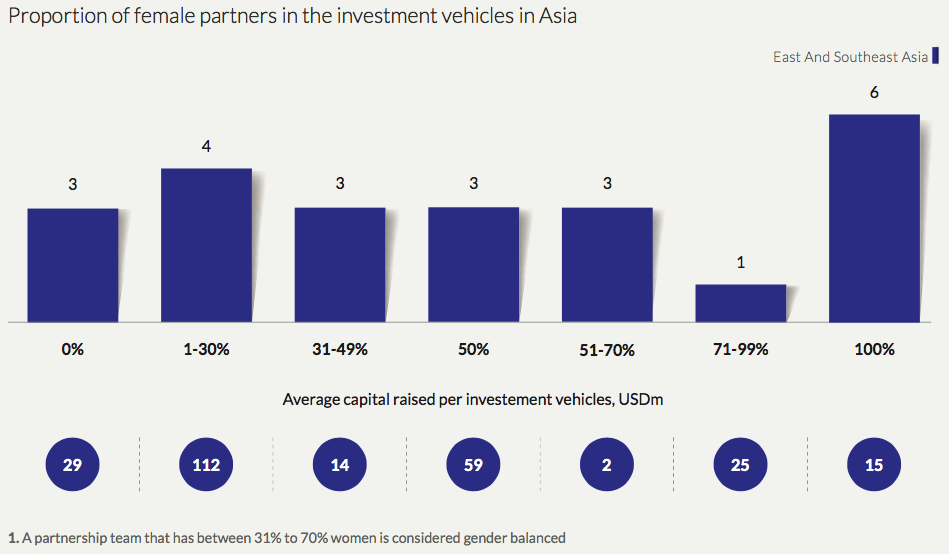

While gender diversity within funds has improved over time, there is still a long way to go, both within Asia and globally. The report defines gender balance as teams that have between 31 percent to 70 percent women. Fifty-two percent of the investment vehicles in Asia have a gender-balanced investment committee, with only 29 percent of them having gender-balanced partnership teams; only 26 percent have both. The global numbers are even lower.

Source: Project Sage 3.0 survey

In Asia and globally, investment vehicles with a female majority investment committee or partnership team appear to be smaller in terms of capital raised. This disparity exists both for first-time funds and later funds.

Related article: Corporate India needs to do more for women

Challenges faced by GLI funds

Despite the interest and increase in GLI there are some prominent challenges that funds face while investing in East and Southeast Asia with a gender lens. These include challenges with investors, portfolio, data, and the use of GLI tools and frameworks.

Educating traditional investors about GLI is difficult, especially since some of them might have preconceived notions about the space. Some investors believe that GLI-focussed funds can only invest in female entrepreneurs, that there is a lower emphasis on financial returns, or that using a GLI framework might reduce the size of the investable universe, and hence returns. Access to GLI products for retail and institutional investors also continues to be a challenge globally.

Female entrepreneurs or businesses focussed on products and services targeted towards women or with women-powered value chains, are less visible in pipelines. Capital allocators may need to do more work to understand where and how to find these businesses, and what those businesses need from investors.

Getting data around gender-specific metrics is a challenge. As a result, investors who wish to prioritise gender in decision-making do not have access to transparent and reliable data on which to base their decisions around creating GLI products or identifying investment opportunities.

GLI tools could be seen as too complicated for busy or resource-constrained investment teams. Even within the same firm, different members could have different levels of understanding with regard to gender issues, and conscious or unconscious biases.

Interestingly, investors also highlighted that they find that using gender terminology in the areas that they focus on (like childcare, eldercare, workplace innovation) could reinforce stereotypes of women’s role in the society, due to which they refrain from using GLI terminology publicly.

While GLI is still at its nascent stage, especially in Asia, it is growing and many inclusive and diverse approaches have been emerging. As the development sector takes upon the COVID-19 crisis, the right approaches towards investment management and resource allocation can go a long way in strengthening the ability of communities to fight and build resilience.

—

Know more

- Read about ways to mainstream gender lens capital solutions for women-led small and mid-size enterprises (SMEs).

- Read this guide on choosing impact metrics for gender lens investing.